- Update 4/1/2018 – I found these recent criticisms (here and here) interesting and well thought out.

- Update 7/1/2018 – A number of prominent progressives have voiced their skepticism of a national Jobs Guarantee in the last few months. See Bivens, Summers, and Baker. I don’t think they fully understand the MMT rationale for the program, but I think they make some reasonable points.

- Update 2/8/2022 – This paper from MIT Econ shows that a Job Guarantee does “nothing” to control inflation.

MMT is a macroeconomic theory of full employment and price stability. In order to achieve this they propose a central policy idea called the Job Guarantee. To understand MMT you must understand that MMT is based on a buffer stock of employed. This means that MMTers do not believe in having a buffer stock of unemployed as is presently maintained. So they are in favor of using the government to ensure that there is ZERO involuntary unemployment at all times. They rationalize this idea by arguing that the government causes unemployment by creating a currency therefore it is their responsibility to maintain full employment. But it’s important to note that this policy idea has never been enacted in any sustained fashion within a developed economy so proponents and opponents of the idea should be skeptical of its efficacy based on little to no evidence that it works.

It’s important to note during these discussions that MMT changes the definition of full employment to “no involuntary unemployment”. Mainstream economics uses a very different definition: “A situation in which all available labor resources are being used in the most economically efficient way.” This tends to cause a good deal of confusion about the JG discussion so it’s important to get on the same page there.

The following outline is designed to provide an unbiased third party perspective. While we are skeptical of the efficacy of the program we are also open-minded to the idea that more evidence could provide greater clarity on its implementation. That said, we do believe that MMT explains the monetary system in a manner that is misleading and that they do so in an explicit attempt to justify this policy based on false operational pretenses. This should raise further skepticism of their policy ideas.

The following points help outline some of the issues with the JG in order to help place the risks in such a large program into perspective:

1. The Core Rationale for the MMT Job Guarantee is based on a False Understanding of the Monetary System

MMT states that unemployment is caused by the imposition of a fiat monetary system. That is, if there were no monetary system imposed by the state then there would be no unemployment to begin with. Therefore, MMT states that it is the creation of the monetary system that leads to unemployment. MMT takes this concept one step further though. They state that the government is the currency monopolist and if the state does not provide enough jobs then the result is involuntary unemployment. Warren Mosler states:

“Involuntary unemployment is evidence that the desired H(net financial assets) of the private sector exceeds the actual H(nfa) allowed by government fiscal policy.

To be blunt, involuntary unemployment exists because the federal budget deficit is too small.”

This concept is misleading in a capitalist system and inconsistent with the most basic understanding of economics. After all, we have known since the time of Keynes, that unemployment results from a shortage of investment. Capitalists do not return all of their profits back to the economy and as a result the economy cannot clear at all times. The problem of unemployment in a capitalist system is not a lack of government issued currency or NFA. The problem of unemployment in a capitalist system is a lack of wealth distribution. Keynes also understood that this issue could cause political strife if inequality were to become exorbitant. But Keynes also understood that some level of inequality was a feature and not a bug within modern capitalist economies therefore he proposed some countercyclical government intervention, but nothing remotely close to the highly procyclical intervention that would be required by a program like a Job Guarantee.

The natural base case in a capitalist system is some level of involuntary unemployment because the capitalists are profit hoarders who seek to protect profit margins. They will never, in the aggregate, maintain full employment at all times because they will never maintain an environment where aggregate demand and aggregate supply clear the market at full employment. This has nothing to do with NFA and government deficits and everything to do with how capitalists naturally behave. The MMT position and “base case” rationale for the Job Guarantee is fundamentally misleading and based on an erroneous understanding of the monetary system. The government does not cause unemployment. Some level of unemployment is that natural state of any capitalist economy.

Further, we know that profligate governments and hyperinflations do not result in reducing employment, but actually increase unemployment. Therefore, we know, empirically, that a lack of NFA cannot be the cause of unemployment.

More importantly, this has nothing to do with the budget deficit and net financial assets. The MMT perspective is little more than an accounting error within MMT wherein they view private sector saving as (S-I) or saving net of investment. MMT has a long history of stating that private sector saving is equivalent to the size of the deficit (S-I) = (G-T). They say that the private sector cannot adequately save without government net financial assets. This completely contradicts the fact that investment adds to private sector saving and is the key driving component of private sector saving. In fact, as of 2012 the quantity of domestically held government bonds (NFA) was just 4.3% of private sector net worth. NFA is not just a small part of private sector net worth. It is practically insignificant relative to other components, yet somehow, in the MMT world this is portrayed as the key driving piece of the economy and unemployment.

By defining “net saving” as (S-I) MMT confuses traditional economics which defines net saving as net disposable income less final consumption expenditure. When MMTers talk about “net financial assets” and “net saving” they are referring to financial savings net of domestic real investment by the private sector. It is not remotely close to representing household savings. By netting this huge quantity of private sector assets they are netting most of the cornerstone assets in our economy such as real estate, corporate stocks, corporate bonds, etc. When we think of “savings” in this sense we marginalize the two most important sources of private savings:

- Surplus from investment.

- Market value of existing assets.

This core misunderstanding is not sufficient to repudiate the Job Guarantee, though it does shed light on many of the problems within MMT. So let’s take a look at this policy more closely before dismissing it.

2. The JG Is Not A Powerful Economic Growth Tool

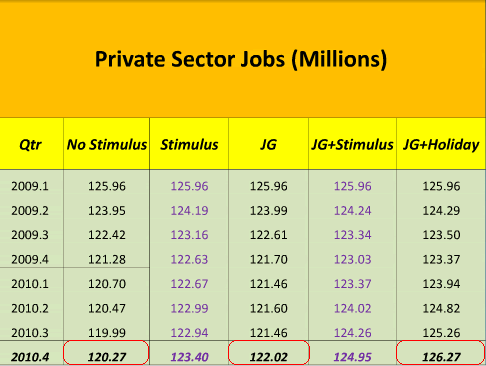

The Job Guarantees positive economic effects are often overstated by MMTers. In a 2010 JG simulation Scott Fullwiler shows that the private sector economic impact is meager when compared to other policy options. As can be seen below, the JG adds just 1.73MM jobs over the 2 years coming out of the deepest recession of the last 75 years when compared to doing nothing. This might not sound like a small gain, but to put things in perspective – a full payroll tax cut adds over 4.25 MILLION private jobs during this same period when compared to the JG scenario. Meanwhile, the government workforce will swell to ~16 million workers!

Interestingly, the JG doesn’t prove much more effective than the stimulus plan that was enacted and proves far less effective than a payroll tax holiday. According to Fullwiler the JG would cost ~$324B over this period while the stimulus cost ~$600B. The stimulus adds 3.13MM jobs while the JG adds just 1.73MM jobs. So while the JG gets slightly better bang for your buck the difference is negligible.

The JG also doesn’t prove to be much of a liquid buffer stock as MMTers often claim it is. Over the course of 2 full years the government workforce grows to ~16 million and just 10% of this contributes to new private sector work. MMTers often claim that the JG will be a more liquid buffer stock, but the JG simulation doesn’t prove to translate into much of a private sector transition program at all. The simulation clearly shows that the stimulus package provided almost twice as many jobs for twice the cost – a negligible difference when compared to the JG option. Perhaps more importantly, it proves that the JG is only highly effective when combined with other stimulative programs of which the other program appears to bear the brunt of the load. In this case, the tax cut clearly provides the most firepower in terms of job creation:

(Source: Scott Fullwiler Presentation, 2010)

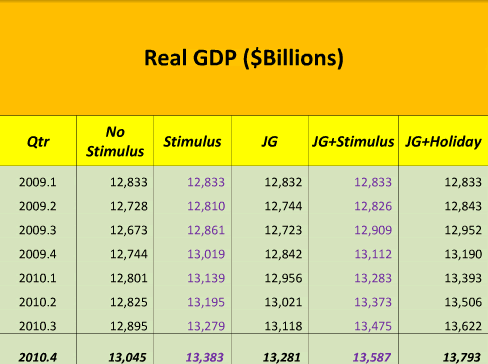

The simulation also shows unimpressive overall economic impact when compared to tax cuts or doing nothing. The JG scenario adds 0.9% to annual GDP coming out of the Great Recession when compared to doing nothing. The fiscal stimulus package, though costing more, outperforms the JG at 1.3% per year. And the full payroll tax cut once again proves to be the primary driving force of economic growth over this period with a substantially larger boost to GDP at 1.9% per year when compared to the JG scenario and a sizable 2.85% per year when compared to the no stimulus scenario. In other words, the positive effects on both economic growth and private employment are underwhelming according to MMT’s own analysis.

(Source: Scott Fullwiler Presentation, 2010)

Some MMTers have claimed that full employment and optimizing output go hand in hand. But that’s clearly not the case based on this evidence. The JG requires additional policy to optimize growth. Full employment is not nearly enough to achieve this. So there’s a clear inconsistency in the MMT idea that the JG is consistent with optimizing growth.

3. The JG Will Not Result In Price Stability

The jobs guarantee is not the “price stability” component that some MMT advocates claim it is. This is the cornerstone of the MMT JG argument (even though Warren Mosler has said its only real role is to serve as a more liquid buffer stock – see below). One of the terms we keep seeing regarding the MMT Job Guarantee (JG) is this concept of it serving as a “price anchor”. The idea that is always attached to the JG is that it will provide full employment and price stability. This is right in theory and entirely unproven in reality. Yes, in theory, the government could really hire everyone they wanted to and they can really set the price of just about anything. But with regard to the price stability issue, the term “price anchor” is misleading as it gives the impression that the JG can serve as an effective way to contain inflation over the course of the business cycle (some MMTers have even gone so far as to make wild claims that the JG could eliminated inflation altogether!). More likely, the JG would serve as a good deflation fighter and only a “soft ceiling” (per Warren) or marginally better inflation fighter than what we have today (sounds good in theory, right!?).

Historically, buffer stock schemes have always failed. One of the primary reasons why buffer stock schemes fail is because the price setting entity ends up always bidding to buy more and more of the commodity than they prefer. Because the market knows they have an upward price bias there tends to be few environments in which the price setting entity is able to sell and put downward pressure on prices. So the buffer stock ends up being a price buoy and not a price anchor. This is well established in commodity markets where buffer stock schemes have never succeeded in the long-term.

Of course, modern governments have become particularly adept at fighting off deflation so the deflation fighting effects of the JG shouldn’t be heralded too much. After all, we’ve had one case of deflation in the last 50 years and it was more than short-lived. It’s not the downside we’ve come to worry about so much, but the upside (today is a rather unusual circumstance given the 100 year balance sheet recession storm). Modern governments have nearly perfected the art of “printing money” in order to offset negative shocks to the economy. Unfortunately, what they’re not so good at is stopping the ensuing boom or coming close to having policy measures in place that halt or alleviate it. While the JG serves as a good deflation fighting policy, it’s effectiveness in stopping high inflation will still rely on the boys switching the policy levers at Fed, Treasury and Congress….In this regard, I think the JG is severely lacking and requires something greater involving counter-cyclical policy (not men with perfectly trimmed beards making predictions!).

Robert LaJeunesse wrote an interesting book titled “Work time regulation as a sustainable full employment strategy” in which he explained the misguided thinking of the JG as a price anchoring buffer stock:

“During robust economic times, buffer stocks offer little prospect of abating wage pressures in the primary sector. Since buffer stocks target a minimum price of labor, an earnings floor if you will, and do not create a wage ceiling they will have little impact on the primary sector wage demands. Capitalists will be able to maintain a significant degree of labor market segmentation, allowing them to avoid hiring from outside the primary sector. As such they will avoid payroll expansion and attempt to squeeze more from existing workers in the form of longer hours and greater work intensification. One only has to look at the history of commodity prices (such as oil) to realize that buffer stocks do not place a ceiling on prices. Buffer stocks may mitigate priceswings, but they tend to prop prices up rather than restrain them, particularly when the commodity is in short supply. Buffer stocks, therefore, do not serve as a price anchor but rather as a price buoy. That is, they represent an earnings floor rather than an earnings ceiling. Public and private sector employees alike will still face pressure to work long hours under a job guarantee – either to maintain insatiable consumption desires or to retain jobs that offer long hours on a take-it-or-leave-it basis. Such behavior would most certainly become inflationary as Mitchell and Wray (2005) concede when they write, ‘if the government decides not to deflate demand, the ELR pool still allows the economy to operate with higher aggregate demand and lower inflation pressures, although inflation can still result.'”

The commodity buffer stock comparison has weak points, but one recent example of this sort of buffer stock idea surrounded the release of reserves from the Strategic Petroleum Reserve in the middle of last year. I spoke to several analysts and traders who, at the time, said the move was a desperate attempt to pull prices down and stimulate the economy. President Obama pulled hard on that buoy and released a small amount of this buffer stock into the market, but he couldn’t pull the prices down for long. Capitalists got back to being capitalists and market dynamics took control once again as prices floated higher. The labor market would work a bit differently, but contains some of the same problems that specific commodity price targeting would. As previously mentioned, buffer stock schemes have never succeeded.

The problem in the labor market is one of money neutrality (a concept that MMTers very publicly reject). In order for the buffer stock to control the market it essentially has to be THE market. But labor is not like any simple commodity. It is a highly specific and specialized commodity. We know this from the remarkable wage discrepancies that exist in the world today. A job at Goldman Sachs is a commodity unlike anything seen in the rest of the labor market. So setting the price of low price unskilled labor doesn’t have a sufficiently uniform effect across the entire labor market to keep wages low when the economy is booming and Goldman Sachs is poaching from Bank of America, Boeing is poaching from Caterpillar, and Microsoft is poaching from Cisco.

To make this point clearer, arguing that the JG is a strong upside inflation deterrent is a lot like setting the price for wool and then claiming that you’ve stopped commodities from rising above a certain point. Clearly, that’s not true. Now, if the government set all prices in the labor market then we’d be having a different conversation, but the JG would cover roughly 3-5% of the unskilled laborers at a point approaching full capacity. Because this buffer stock will have been dwindled down to largely low-skilled workers whose convertibility into private sector jobs is now negligible, it will have an equally negligible impact on the broader wage scale.

So the upside benefits will be relatively muted regarding price stability during an economic boom (when we’re nearing traditional “full employment”). Additionally, the job guarantee pool at 3-5% of all unemployed will be so small and non-convertible into widespread private sector jobs that it won’t come close to impacting prices and wages to the extent that private sector jobs will (which will see substantial wage pressure during a boom period as skilled laborers compete for the other 95-97% of jobs. As Mitchell and Wray say, this would most certainly add to aggregate demand during the boom times which would lead to higher inflation. Ultimately, we will still rely on counter cyclical policy to be implemented at levels of full capacity regardless of whether we have a buffer stock of unemployed or employed so the fact that the employed buffer stock acts as a price buoy and not a price anchor is quite substantial. Given the fact that modern governments have become particularly adept at fighting deflation, I think the inflation fighting case for the JG is vastly overstated.

One point that many MMTers make is that labor is sufficiently undifferentiated to allow a JG to reduce wages across the entire spectrum of wages. But this argument doesn’t hold true and is in fact a massive contradiction in MMT beliefs. MMTers have spent the last few years arguing over “income inequality”. The problem here is that they’ve created a price stability theory based on income equality. The fact is, it is the rich who control the price spectrum because it is the rich who spend the majority of the money in the USA. The top 20% of Americans do 50% of the spending. But the JG supporters are trying to have it both ways. They want to claim that the JG can contain inflation due to undifferentiated wages, but also claim that the income inequality is a problem. Clearly, the JG isn’t nearly the inflation fighting component of the theory as it is advertised to be. In fact, there is a very real chance that once the bill gets ratified and in the hands of the lobbyists that it could either cause greater income inequality (by pegging low wages) or be highly inflation when the lobbyists push the $16 wage to $20, then $25, then $30 as cost of living adjustments pressure law makers to alter the plan….

This leads into a final and more theoretical reality of the potential negative impacts of the JG – wages. Some MMTers have proposed a living wage of $16/hr.https://therealnews.com/t2/index.php?Itemid=74&id=31&jumival=6633&option=com_content&task=view

This is $8.75 higher than the current minimum wage (generally unskilled labor and fairly rigorous work). The risk in the JG is that we pay people for rather easy to perform unskilled labor. For instance, the jobs in Wray’s book “understanding modern money” include Artist, musician, companion. Why would anyone desire to work for the private sector at a rate of $16/hr for a more rigorous form of work when they could have the rather lax govt job at $16/hr? More importantly, what is the trade-off between JG jobs and higher paying jobs in the real economy? Does a family of two playing music for the govt at a wage of $16/hr (with full health benefits) really want to enter a more rigorous form of work for $20/hr? What is the impact on private sector wages then and does this force the private sector to substantially boost wages in order to attract workers out of the JG (mind you, this assumption involves a very low JG wage to begin with – in all likelihood the political pandering and unionization of the JG would drive this wage much higher)? These are substantial and potentially ruinous risks that are largely overlooked or vastly overstated in the JG research.

In short, the inflation fighting components of the JG are vastly overstated and fail to identify and properly model the potential risks.

4. The MMT “Money Monopolist” Idea Is Misleading

The JG is based on the myth that the USA has a “money monopoly”. This is based on the state theory of money that MMT bases much of their work on. But this is misleading to say the least. The USA is designed with a market based money system in which private banks issue the majority of the money and government and the private sector use the money. In fact, the entire Federal Reserve System exists as a means to facilitate and stabilize the existence of private competitive money creation via banks. This system exists to create a clear firewall between the private market based money system and the government so as to disperse the power of money creation away from the government.

There is no “money monopolist” in such a system. In fact, the private banks are an oligopoly. The current monetary arrangement involves a public/private partnership with the banking system in which the banks issue the dominant form of money (inside money) and the government issues a facilitating form of money (outside money). The banks wield enormous power over money creation and in fact issue almost all of the money that is used for every day economic purposes.

A monopolist can be defined as an entity that controls both price and supply. But in the case of the private banking system, the government controls neither the price of debt nor the supply. But MMT uses a convoluted hierarchical approach to money to give the appearance that the state is a monopolist. They then use this argument to position their policy proposals at the forefront of the theory. This approach is not grounded in reality, but instead distorts reality to attempt to create a cohesive academic argument for the reasons why unemployment exist and why the government is the only entity that can solve this problem.

MMT often stretches the truth of the way our system works in order to give the appearance that the government is the money issuer. This can be seen in some strange descriptions in the founders’ examples of MMT and the way this power structure is designed. Bill Mitchell uses an example of a parent starving his children https://bilbo.economicoutlook.net/blog/?p=7864:

” I then sit back in my chair and suggest that:

Any child who wants to eat and live in the house must pay me, say, 600 business cards each month for the privilege.

The kids respond in unison, almost immediately:

When do we start work?”

Warren Mosler uses a similar example in Soft Currency Economics, the paper that is broadly cited as the founding paper of MMT:

The concept of fiat money can be illuminated by a simple model: Assume a world of a parent and several children. One day the parent announces that the children may earn business cards by completing various household chores. At this point the children won’t care a bit about accumulating their parent’s business cards because the cards are virtually worthless. But when the parent also announces that any child who wants to eat and live in the house must pay the parent, say, 200 business cards each month, the cards are instantly given value and chores begin to get done.

Warren Mosler uses an example of a man locking people in a room with a gunhttps://moslereconomics.com/2009/10/23/taxes-and-money/:

taxes and money

Posted by WARREN MOSLER on October 23rd, 2009

[Skip to the end]

you are addressing a room full of people.

you tell them taxes turn litter into money.

you try to sell your business cards to the group for $5 each.

probably no takers.

you offer your cards to anyone who stays to help clean up the room

no takers.

you then point to the man at the door with the 9mm who’s the tax collector, and no one leaves without 10 of your business cards.

you then repeat the questions.

[top]

And how do the cards get valued?

Simple, the monopolist sets the terms of exchange.

Another common example is the UMKC Buckaroo which is the currency the school has implemented in order for students to accomplish their required community service.https://www.huffingtonpost.com/warren-mosler/the-umkc-buckaroo-a-curre_b_970447.html

The Buckaroo is an egregious abuse of the school’s powers in trying to execute an economic exercise. In fact, the Buckaroo proves why the coercive monopoly argument is wrong. The students did not choose to have the Buckaroo. The school imposed it on them via a coercive monopoly. In doing so they have directly reduced the living standards of their students by forcing them to spend their time doing something that other comparable college students may not be required to do (regardless of the good that comes out of the community service). Interestingly, some UMKC students agree with me here. Here is a recent comment from an anonymous UMKC student:

“I personally find [the Buckaroo] a little silly, and yes the way the currency came about was not through representative democracy but an absent dictator (Mosler). Nevertheless, the end result is that both are coercive, but you’re right that the way the Buckaroos was introduced was anti-democratic and should be overthrown.”

You can see that the common thread in all of these examples is an authoritarian coercive monopoly supplier. This is done to give the appearance that the state controls the monetary system through issuance. While it is obvious that money in the USA is denominated in dollars (by law) the system is also designed in a manner that specifically contradicts the idea of the money monopolist. The system in the USA is specifically designed to sustain a competitive private money issuing market based system.

This position has also been criticized by post-Keynesian Perry Mehrling:

“Wray recounts some of this history (pp. 61-69, 98-102) but misses its significance. The significant point is that our government is our creation. It is only able to tax us to the extent that we allow it to do so. Its taxing authority arises not from its raw power but from its legitimate authority. Further, our state arises out of a thriving private civil society, not the reverse, as the colonial parable would have it. Our state is not a king demanding bounty, and consequently the argument that the power to tax is the source of money’s value does not seem very compelling.”

I believe MMT should eliminate these conflated perspectives as you do not need it to promote the Job Guarantee idea. Anyone who understands modern monetary operations and the institutional design of the US government can understand that the US government can’t “run out of money” since it can always procure funding by harnessing the Primary Dealers as funding agents or raising tax funds. So solvency or procuring funds for such a program is never a concern. There is simply no need to use the conflated MMT approach that claims private for profit banks are somehow in the business of serving public purpose when they are clearly in the business of serving private shareholders, ie, they are not part of any government money monopoly, but are instead part of a very powerful private oligopoly.

5. History Shows That The JG Is Ripe For Corruption

The biggest irony in the JG is that our large govt has already made any such policy a near certain blunder. Even Mitchell and Wray acknowledge “many of the details surrounding implementation and operation of an ELR programme remain to be solidified” (Mitchell and Wray, 2005, p. 15). Implementation casts a large shadow over this program. For instance, the regulations involved in implementing it are near impossible to get around (via Beowulf):

Look at Obama’s cash for caulking program. A $5 billion federal weatherization program intended to save energy and create jobs has done little of either, according to a new report obtained by ABC News on the one-year anniversary of President Obama’s American Reinvestment and Recovery Act….

The Department of Labor spent most of the past year trying to determine the prevailing wage for weatherization work, a determination that had to be made for each of the more than 3,000 counties in the United States, according to the GAO report.

Secondly, many homes have to go through a National Historic Preservation Trust review before work can begin. The report quoted Michigan state officials as saying that 90 percent of the homes to be weatherized must go through that review process, but the state only has two employees in its historic preservation office.https://abcnews.go.com/WN/Politics/stimulus-weatherization-jobs-president-obama-congress-recovery-act/story?id=9780935#.Tw0GxiP5l7E

To which Morgan Warstler added this comment:

I actually sat very very close to the “weatherization” plans Obama put out, and watched them happen at the local level in two different states – places where I knew contractors who actually SAT THROUGH the meetings all the way to doing a couple houses.

Worse than ugly. From catered lunches to administrators letting everyone out of the mandatory 8 hour meetings early, to unions insisting these workers needed $50 per hour, to the labor dept demanding polling done across the country to determine the proper wages… I’m convinced it was weatherization that caused Obama to decide there is no such thing as shovel ready jobs.”

IF a job guarantee is a core element of MMT, then what Morgan proposes [a pritivized “Ebay hiring hall” is the only way it could work that won’t turn it into a political train wreck. This isn’t the 1930s, you can’t just hire people off the street to carve a road through the woods. Every government construction project requires a NEPA report. And the NEPA Act is pretty damn broad. For example, you can’t build a cell tower anywhere in the country– FCC licenses trips the NEPA requirements– until you’ve submitted a report addressing these areas of concern (I’ve cut the cell tower specific items):

Officially designated wilderness and/or wildlife preserves.

Officially designated critical habitats, or areas having threatened or endangered species which are likely to be jeopardized.

Section 106 review for districts, sites, buildings, structures or objects, significant in American history, architecture, archeology, engineering or culture that are listed, or eligible for listing, in the National Register of Historic Places.

Section 106 review for Indian religious sites.

Flood plain designations.

Areas which would require significant change in surface features (wetland fill, deforestation or water diversion).https://www.epacinc.com/checklist.php

And then when its time to hire people, govt funded projects have their own unique “minimum wage” for every job classification in every county in America, the Davis Bacon Act…

Environmental groups and the AFL-CIO will lobby to kill (and will kill) any bill that tries to waive this red tape. The only way to avoid all this is to structure it just as Morgan suggested, as a “Ebay hiring hall” for private sector employers to bid on hiring unemployed workers (if there’s not a transparent auction process, the buddies of politicians will be getting a lot of free labor). Instead of funding the wage subsidy out of unemployment trust fund, I’d structure it as an employer tax credit to avoid any legal argument that the winning bidder is a govt contractor subject to the above red tape.”

6. More On Waste And Corruption

Can such a huge government program be administered without massive waste and corruption? To put this in perspective consider the fact that Randy Wray says the program might involve as many as 20 million employees. This is a MASSIVE undertaking that will require almost a whole new government just to manage and maintain. I don’t think one can overlook the potential for huge unintended consequences from what would amount to the largest government undertaking ever. All for what? Just so we can say we bumped that 97% employment figure all the way up to 100%? Just so some economist can validate his models? At what cost? Did the living standards of the 97% increase? If not, then what kind of Constitutional Republic are we running here? Or are we even running a Constitutional Republic and not some modern day version of Social Capitalism?

Corruption is a real concern and has been validated in current job guarantees around the world. As of April 10, 2012 India’s version of a Job Guarantee, known as the NREGA has come under fire for mass corruption. IPS reports:

“Yet, in spite of its massive public spending budget, NREGA has come under withering criticism, starting with allegations of corruption in several states.

In northern Uttar Pradesh, massive siphoning of NREGA funds by officials and local administration, including village panchayat heads, has now led to the minister for rural development, Jairam Ramesh, calling for an official inquiry.

The largest of the NREGA scams in Uttar Pradesh emerged from the constituency of Sonia Gandhi, the leader of the ruling Congress party. Not surprisingly, the Congress party fared badly in provincial elections held in the state, India’s largest, in March 2012.

Critics say NREGA’s massive public expenditure is a drain on India’s economy, besides affecting industry by pulling away its labour force and promoting a ‘welfare ethic’. “

The following is via Ramanan on more corruption in the Indian JG:

Once the late PM of India Rajiv Gandhi said that:

“If Central government releases one rupee for poor, only 10 paisa reaches them.”

https://zeenews.india.com/news/archives/is-corruption-in-our-dna_725837.html

Here is an example of a scam (and there are plenty of them)

https://indiatoday.intoday.in/story/nrega-scam-sandeep-dixit/1/157810.html

Wikipedia also has extensive criticisms of the NREGA plan:

Many criticisms have been levelled at the programme, which has been argued to be no more effective than other poverty reduction programs in India. The program is beset with controversy about corrupt officials, deficit financing as the source of funds for the program, poor implementation, and unintended destructive effect on poverty. A 2008 report claimed the state of Rajasthan as an exception wherein the rural population was well informed of their rights and about half of the population had gained an income from the entitlement program.[9] However, a 2011 WSJ report claims that the program has been a failure. Even in Rajasthan, despite years of spending and the creation of government mandated unskilled rural work, no major roads have been built, no new homes, schools or hospitals or any infrastructure to speak of has resulted from the program.[10]

At national level, a key criticism is corruption. Workers hired under the MGNREGA program say they are frequently not paid in full or forced to pay bribes to get jobs, and aren’t learning any new skills that could improve their long-term prospects and break the cycle of poverty. There are also claims of fictitious laborers and job cards by corrupt officials causing so called leakage in program spending.[10][11]

Another important criticism is the poor quality of public works schemes’ completed product. In a February 2012 interview, Jairam Ramesh, the Minister of Rural Development for the central government of India, admitted that the roads and irrigation canals built by unskilled labor under this program are of very poor quality and wash away with any significant rains. Villagers simply dig new irrigation pits every time one is washed away in the monsoons. The completed works do not add to the desperately needed rural infrastructure.[11][12]

Another criticism is financial. The MGNREGA programme spent US$ 9 billion in the 2011 fiscal year according to official data. Economists have raised some concerns about the sustainability of this subsidy scheme – India’s fiscal deficit is expected to reach 5.6 per cent of GDP this year, compared with 5.1 per cent last year. The MGNREGA program has been found to distort labor markets and has helped — along with fuel and fertilizer subsidies — to balloon India’s federal fiscal deficit.[13][14]

Yet another criticism is the unintended effect of MGNREGA in terms of skill growth. A review published by India in September 2011 conceded that the lack of skilled technicians at almost every site under MGNREGA program, along with rules banning the use of machinery or contractors (labour is usually by shovel). Such bureaucratic regulations mean that the labourers learn no new skill, and that the ponds, roads, drains, dams and other assets built with manual labour are often of wretched quality. The idea behind MGNREGA program is to create as many jobs as possible for unskilled workers. But in practice, say critics, it means no one learns new skills, only basic projects get completed and the poor stay poor — dependent on government checks.[10][12]

“We work because there’s high unemployment here and the land is less fertile.” But he questioned the point, saying “There’s no meaning to it. Instead of this they should build proper roads.”

— Abdul Jameel Khan, a farmer employed by India’s MGNREGA entitlement program quoted in a 2011 article by The Wall Street Journal[10]

A multi-crore fraud has also been suspected where many people who have been issued the NREGA card are either employed with other Government Jobs or are not even aware that they have a Job Card. The productivity of laborers involved under NREGA is considered to be lower because of the fact that laborers consider it as a better alternative to working under major projects. There is criticism from construction companies that NREGA has affected the availability of labor as laborers prefer to working under NREGA to working under construction projects. [15]

It is also widely criticized that NREGA has contributed to farm labour shortage. In July 2011, the government has advised the states to suspend the NREGA programme during peak farming periods.[16]

The National Advisory Committee(NAC) advocated the government for NREGA wages linkage with statutory minimum wages which is under Minimum wages act as NREGA workers get only Rs100 per day.[17]

This sort of corruption puts a nail in the JG coffin as far as I am concerned. MMTers can either bury themselves with this program or accept that it’s not a core piece and give the world the gift of understanding modern money. But modern money need not involve massive govt labor programs

7. Are There Enough Productive Jobs To Be Performed?

What are the jobs these employees would perform and would they be productive? The list that Randy Wray notes in his research (which includes musician, artist, companion, ie babysitter, clean-up “engineer”, etc) will not hold a candle to the Republican furor that such a program would confront. Artist, musician, companion? You have to do much better than that. It’s hard to even take the JG seriously given this list of “jobs”. In fact, many of them are merely hobbies….Will the govt pay me to play golf? I could be a “golf course engineer”. I could travel the country playing golf every day ensuring that other golfers have companions and are entertained….Of course I am being playful, but you get the picture I am painting here. MMT believes the govt can hire 30 million workers in productive jobs that will not result in potentially harmful side effects that render the hiring counterproductive. I don’t see convincing evidence that this is the case.

8. Will This Increase Living Standards For Society As A Whole?

What would be the effect on broad living standards? Is this just a form of welfare on steroids? Some people have justified the program under the notion that it’s no different than unemployment benefits except you’re making people earn it. But this ignores the fact that the JG is not temporary like UE benefits. The JG would become a permanent and massive form of workfare. Further, can JG supporters prove that this program will create greater prosperity than other models over a multi-generational period? That would be enormously difficult to prove….

Are there enough productive jobs to justify the potential rise in prices that could occur from demand pull inflation (oil, gas, food, etc)? Bill Mitchell says there will be a “one off” rise in prices, but this assumes a perfect elasticity of supply. Anyone watching the oil markets in recent years know this is not a hard and fast rule. More demand is not always met by more supply. Since the program is permanent it’s likely that the effect on prices will become permanent (again, just wait til the army of lobbyists get involved fixing prices, benefits, etc etc) to some degree. This will be a largely permanent allocation of Federal spending going towards the JG. If the transition isn’t as smooth as theorists expect or any other of numbers eat into its counter-cyclical effects then the program because ripe to becoming a massive case of malinvestment.

9. What Are The Potential Praxeological Effects?

What are the psychological effects over time? Does this actually disincentivize workers? Does the program become permanent employees sitting around on the permanent government dole? ~70K with full health benefits for a family of two working as “artists” is pretty good to a lot of people. What is the effect on employers? Will they fire their current workers and hire JG workers at a marginally higher rate than the JG? Will they hire them at all? Do kids drop out of high school to join the govt arts and music program? Will the doubling of the minimum wage through the JG wage actually cause a reduction in private sector employment as employees move out of the private sector into the JG? The questions and psychological effects here are numerous….

Are there enough productive jobs to justify the potential rise in prices that could occur from demand pull inflation (oil, gas, food, etc)? Bill Mitchell says there will be a “one off” rise in prices, but this assumes a perfect elasticity of supply. Anyone watching the oil markets in recent years know this is not a hard and fast rule. More demand is not always met by more supply. Since the program is permanent it’s likely that the effect on prices will become permanent (again, just wait til the army of lobbyists get involved fixing prices, benefits, etc etc) to some degree. This will be a largely permanent allocation of Federal spending going towards the JG. If the transition isn’t as smooth as theorists expect or any other of numbers eat into its counter-cyclical effects then the program because ripe to becoming a massive case of malinvestment.

10. What’s The True Goal Of The JG?

There has been some confusion as to the purpose of the JG. Warren Mosler, for instance, does not even claim that its goal is to increase demand. In fact, he says it could decrease demand https://moslereconomics.com/2012/01/09/politics-shifting-towards-jg/:

“I didn’t design the JG to raise demand. It might even lower it, which would be a good thing, as that would mean lower taxes for the rest of us.

It’s designed to get keep the unemployed shovel ready to go to work in the private sector, and at the same time reduce the real costs of sustaining an army of unemployed.”

This raises all sorts of questions. If it won’t raise demand then that confirms our thinking that it’s not a superior deflation fighter. Further, the JG will still be entirely dependent on OTHER policies to increase demand when needed. So it doesn’t serve as a demand buffer at all. The Fullwiler presentation proves that it’s not a particularly good liquid buffer stock. So what exactly does the JG do? Is it really just a political proposal presented as an economic tool? Is it just a larger form of workfare? Is it just a way for economists to claim they solved the full employment puzzle?

Further, how can we know that the JG would make workers more liquid when their own simulation proves that the economic benefits of this transition job are muted at best? We’ve never had a JG in place so there is no testing this statement outside of their unconvincing simulations.

Lastly, this point is important because it touches on some of the points above. It’s clearly not the inflation fighting mechanism advertised by some MMT advocates. And it won’t even increase demand! So what really is the role of the JG? This all circles back to Marx’s “reserve army of unemployed” statements and while I hate to get political I can’t help but wonder how the JG is not a highly politically motivated move towards a more socialist agenda, given the facts above…. MMTers admit that it won’t raise demand, won’t boost economic growth substantially, won’t serve as a good liquid buffer stock….The economic data from their own simulations is underwhelming and the risks involved in the largest bureaucratic undertaking in human history would be colossal. Their conclusions simply don’t add up.

This makes one wonder whether the JG is simply a moral position. Perhaps the JG is designed as a tool to provide a living wage for everyone and little more? If so, I think that the argument can be made, quite powerfully, that there is a rationale for a JG since we reside in a monetary system where an income is a necessity, but where capitalists also won’t supply everyone with an income. But that is a moral argument and not an economic argument.

11. A Program Of This Magnitude Has Never Been Implemented And Can’t Be Modeled Accurately

There is a lack of modeling showing that a JG can be implemented in the first place. As [I] noted, it has never been done. However, an unemployment buffer has been proven to work to achieve prosperity over long time periods. The employment buffer has never been proven and will require a huge amount of factual data and proof to overcome the uncertainty. Some claim an unemployment buffer has failed us. But over 23% of all the goods and services made since 1AD were produced from 2001 to 2010. And despite claims of “American exceptionalism” it’s difficult to overlook the FACT that America, in just 235 years, has built the most dynamic, prosperous and wealthy nation that man kind has EVER seen. To claim that the world is not making enormous strides in terms of productivity and living standards is not grounded in reality. Yes, we are currently suffering mass hardship due to the balance sheet recession (which was caused in large part by money manager capitailsm – something I’d help resolve via the full productivity program), but let’s not take things out of context here by losing sight of the forest for the trees. There was no unemployment in our caveman days, but certainly you wouldn’t argue that living standards were higher then….If you’re going to build a model for the JG then you have to essentially prove that the current model (the greatest wealth and prosperity creating machine in human history) is broken and that your new model is better.

The problem with current models…They’re built on a total lack of empirical evidence. JGers are building models based on the same sort of thinking that goes into efficient market models. The problem with models like this is that you don’t know what’s wrong with them until they break. And the problem in any JG model is the praxeological effect. No one knows what the true behavioral response will be. You’re assuming a Chicago School style of rational choice. It’s a colossal error! Economists have built broken models based on these false assumptions time and time again.

Unfortunately, the only true way to know if a JG is workable is to implement one and find out. Only then can we actually test the theory, because, yes, this is almost entirely theory! Implementing it in an economy as large, diverse and complex as the USA on any large scale would be beyond irresponsible. And yes, as a citizen of this country who cares deeply about its well-being, there is no way I could ever back such a policy without substantial empirical proof of its effects. Perhaps over time these programs will develop in smaller comparable countries, but until there are real workable models then I am afraid that the models are built on quick sand….

Conclusion. The policy option of a Job Guarantee is an interesting proposal and one that is worth considering. However, there are many unanswered questions about such a program. It will require significantly more evidence and real-world testing before we can make any financial conclusions about such a program.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.