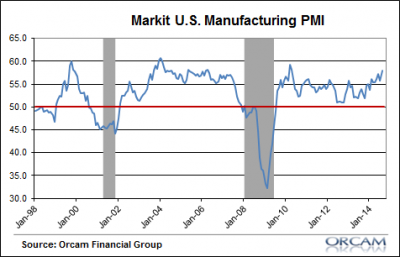

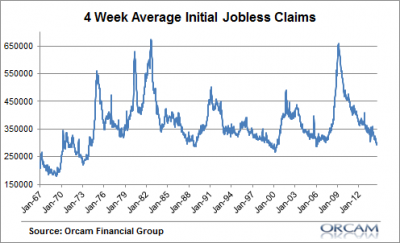

Sometimes it’s easiest to understand the big picture with the simplest indicators. And two of the more trust ones in the macro arsenal are the PMI reports and the weekly jobless claims reports. They’re not exactly “real-time”, but when you’re taking the macro view (which is an inherently longer-term perspective) then these are pretty close to as “real-time” as we need.

The first chart is the Markit US Manufacturing PMI. Yesterday’s Flash release for August showed a 17 month high at 58. 50 is the contraction level so we’re now running pretty quickly in the opposite direction there. The US economy, as I continue to argue, is stronger than it’s getting credit for.

The second chart is weekly jobless claims. Claims have continued to move lower since the crisis highs and came in at about 300K this week. That’s up marginally from recent lows, but the long-term trend is still in the right direction.

I don’t want to read too much into just two indicators, but when we take into account the bigger picture this reinforces my opinion that the balance sheet recession is fading and the economy is normalizing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.