Just some random gold thoughts here via David Rosenberg’s 2013 outlook:

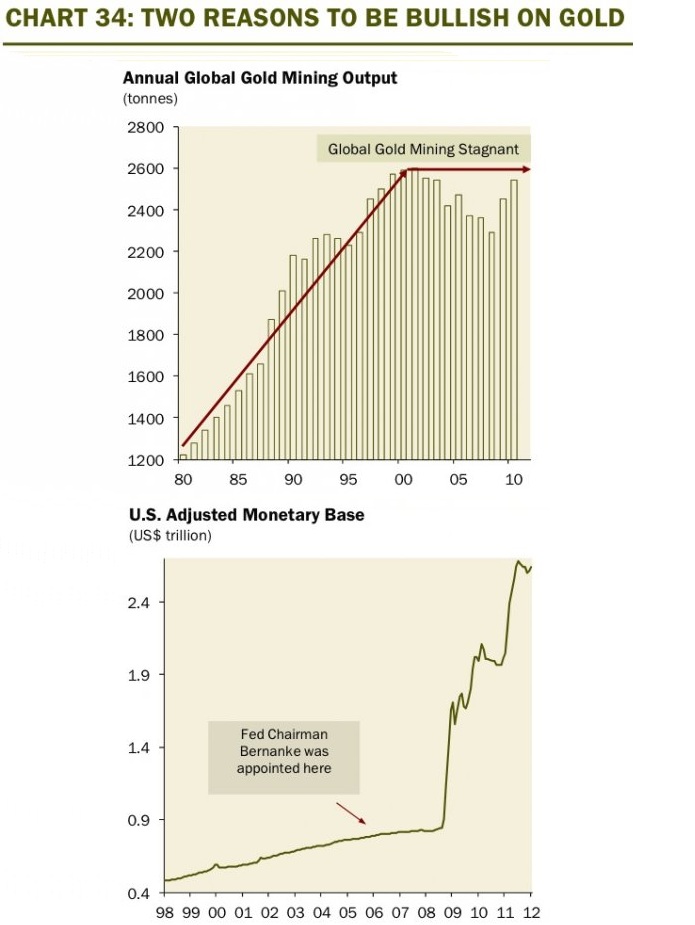

“Gold is also a hedge against financial instability and when the world is awash with over $200 trillion of household, corporate and government liabilities, deflation works against debt servicing capabilities and calls into question the integrity of the global financial system. This is why gold has so much allure today. It is a reflection of investor concern over the monetary stability, and Ben Bernanke and other central bankers only have to step on the printing presses whereas gold miners have to drill over two miles into the ground (gold production is lower today than it was a decade ago – hardly the same can be said for fiat currency). Moreover, gold makes up a mere 0.05% share of global household net worth, and therefore, small incremental allocations into bullion or gold-type investments can exert a dramatic impact. Gold cannot be printed by central banks and is a monetary metal that is no government’s liability. It is malleable and its supply curve is inelastic over the intermediate term. And central banks, who were selling during the higher interest rate times of the 1980s and 1990s, are now reallocating their FX reserves towards gold, especially in Asia. With the gold mining stocks trading at near record-low valuations relative to the underlying commodity and the group is so out of favour right now, that anyone with a hint of a contrarian instinct may want to consider building some exposure – as we have begun to do.

…

In that light, the bond-bullion barbell continues to make sense to us within a diversified portfolio that includes the parts of the equity market that trade like a bond.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.