There’s a lot to be pessimistic about with all the downside risks in the macroeconomy. Europe is teetering on the edge, the fiscal cliff is all anyone can talk about and even China is showing some signs of a hard landing. But things could also be a lot worse than they are. While I primarily like to focus on the risks that can trip investors up, I also like to maintain a measured optimism.

That said, here are three things that aren’t worth being negative about (at present):

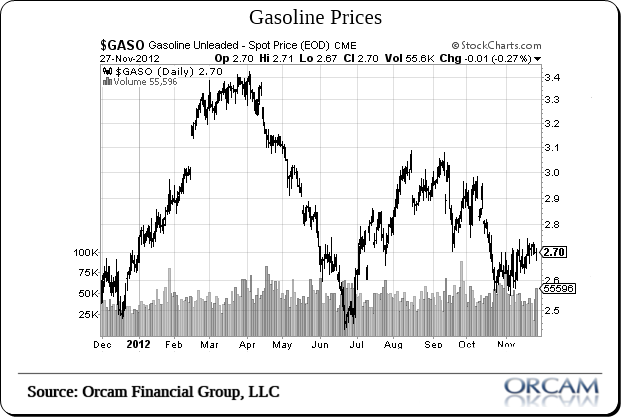

Gasoline prices are falling. Gasoline prices can be an enormous tax on the consumer and while gas prices are up substantially over the last 4 years, prices are up just modestly in the last year. More importantly, they’re down almost 20% from their highs earlier this year.

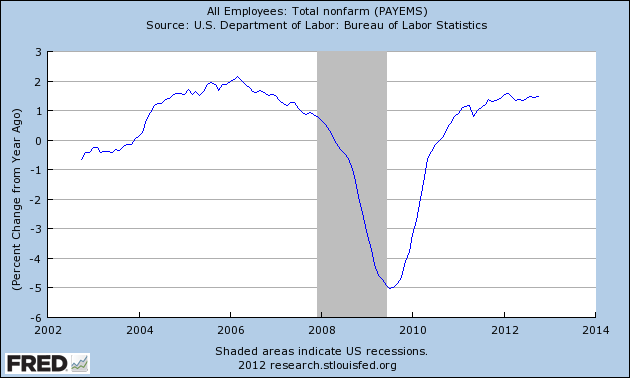

The job market is still expanding. Few things are more damaging to the economy than layoffs. And while the labor market isn’t exactly strong it’s definitely not contracting. In fact, the year over year gains in employment aren’t much worse than the 03-07 recovery.

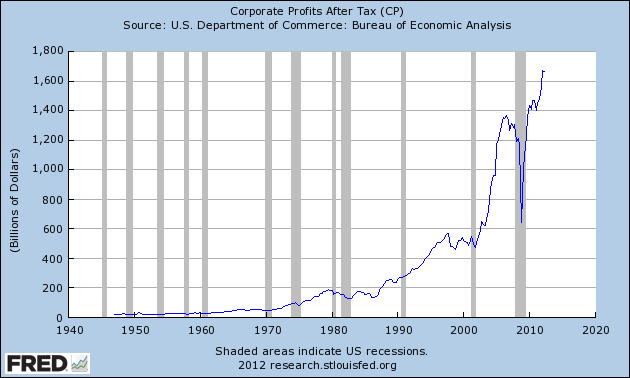

Corporate profits are at an all-time high. Although the consumer remains fragile US corporations are actually quite strong. This is clear from the state of corporate profits, which are at an all-time high.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.