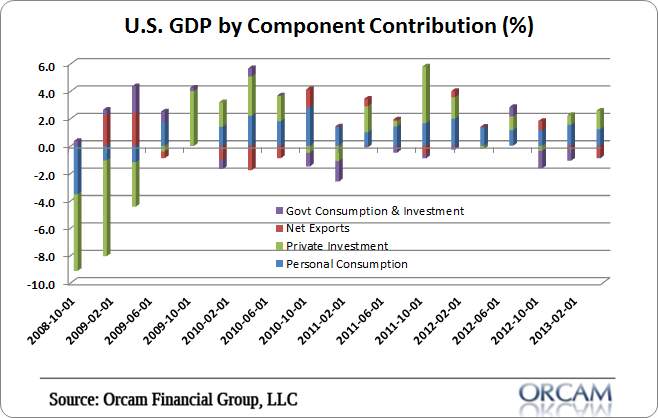

Real GDP came in at 1.7% this morning which was better than expectations of 1.1%. But the better than expected results came with some hefty revisions. Last quarter’s 1.8% reading was revised down to 1.1%. The gains in this quarter’s data continue to come from private investment which contributed 1.34% to the overall reading. Personal consumption was weaker than Q1 at 1.2%. Net exports dragged RGDP down by -0.8% and the government drag was a paltry -0.1%. See the chart below for details.

I’ve really been hammering home the point about private investment since the beginning of the year in order to try to steer people away from the belief that the sequester and the government’s reduction in the deficit would derail the economy. It’s better to look at the economy from the perspective of private investment and whether that component is being offset by other components. Thus far in 2012 we’ve seen steady contributions from private investment and a drag from the government. The overall result is still a growing economy even if it’s not booming. In other words, as the Balance Sheet Recession ends and the private sector starts to re-lever, we’re seeing the private sector carry the load that the government has been carrying for the last 4 years.

More interesting is a closer look at private investment. You might assume that the current improvement in private investment is due to real estate. But it hasn’t been. It’s actually come from the non-residential side. Of the 1.34 point contribution residential was only 0.38. In other words, lots of other parts of the economy are starting to pick up the slack on the private investment side. This is not just a real estate recovery.

Overall, it’s not a great report and it’s not a terrible report. It’s sort of what is to be expected in this sort of a muddle through environment where we’re crawling out of this huge debt hole and the private sector slowly regains its footing. The big risk to the recovery still remains a sharp decline in the government’s deficit that is not offset by private investment. I still don’t see that happening. I think the sequester and the overall cuts ended up being much smaller than most expected. We’ll see what happens with the next round of debt ceiling talks, but for now it looks like more muddle through where the private sector continues to gain its footing and the government eases off the gas.

Chart via Orcam Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.