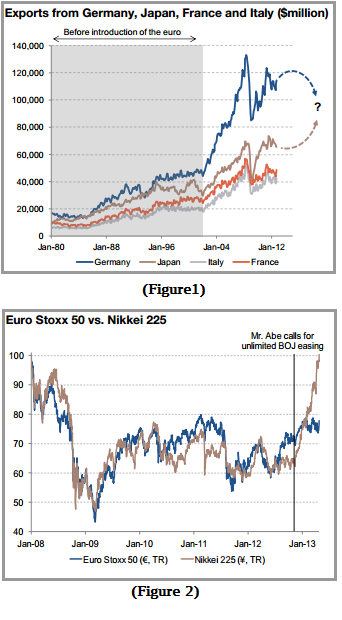

I was going through a recent note from SocGen’s Patrick Legland and came across a nice visualization for potential problems from Japan’s QE program. As I’ve mentioned before, Japan’s Yen strategy is inherently zero-sum. That is, if the lower Yen boosts Japanese growth then it’s essentially stealing from someone else’s growth. We’ve seen this most clearly in Europe in recent years where the weak Euro has benefited Germany and not the periphery nations (who are all current account deficit nations). So it’s interesting to note that the decline in the Yen is hurting…Germany!

This is interesting because of some of the recent calls for the ECB to copy the BOJ’s easing policy. Of course, the Japanese are benefiting from the loss of trade in other nations. So, once we all start engaging in a “race to the bottom” it would be irrational for stock prices to reflect this environment benefiting everyone involved. And as we’ve seen in Europe, the stock markets do not reflect benefits for all as many peripheral nations are seeing stock indices near record lows.

Here’s more via SocGen:

“Germany most impacted by yen decline

Germany’s latest PMI remains in contraction territory at 47.9, reflecting worries on business expectations. Looking at the global picture, since the introduction of the euro (2002), Germany has benefited from a weak euro to increase its exports, especially in the past few years (see figure 1). Indeed, according to the Bundesbank, one of the key factors which supported German exports in 2012 was the euro’s lower external value along with an attractive product range. But, with the change of the BoJ’s policy, the recent sharp fall of the yen (-25% within 6 months) could have a negative impact on German exporters (facing direct competition from Japan). It may offer an opportunity for the eurozone to relaunch cooperation and send the euro lower. But, the more urgent concern for eurozone leaders is to address financial fragmentation and structural rigidities in each country.

The BoJ may trace a new path for the eurozone

As mentioned by our economists, the current economic environment may force the ECB to adopt new

unconventional measures. But, as there are limits to what more the ECB can do alone, eurozone politics are facing a dilemma: either to continue the current austerity policy with a risk of 20 years of deflation (like Japan’s ‘lost’ decades) or to adjust policy in line with recent change of BoJ policy; the impact of which remains to be seen. Since Mr Abe’s election last November, Japanese equity markets reacted positively,

whereas eurozone markets are still waiting for a positive signal. The eurozone probably needs a similar shock – be it political, economic or monetary – for its equity markets to climb back to 2008 pre-crisis level. This shock would be necessary to restore confidence (like it did in Japan) and save the eurozone from further turmoil.” (see figure 2)

Source: Societe Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.