Today’s personal income data caused a number of firms to upgrade their estimates for Q1 GDP. Here is a smattering of estimates (some old, some new) for Q1:

- Consensus: 2.8%

- Merrill Lynch: 3.0%

- Nomura Securities: 2.5%

- Goldman Sachs: 3.4%

- Macro Advisers: 3.5%

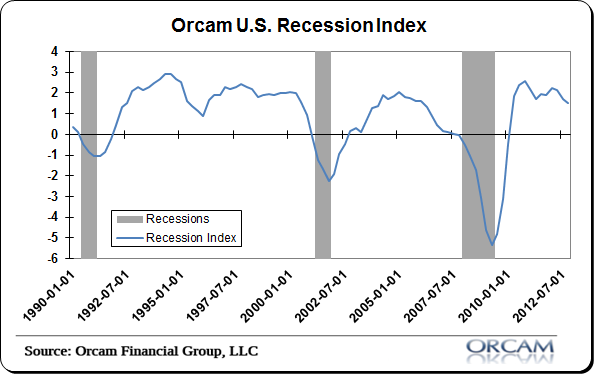

The Orcam Recession Index is (has been) telling a similar story – the risk of recession remains low (Via Orcam Investment Research):

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.