I finally got around to reading Buffett’s annual letter to shareholders. It’s as entertaining and educational as always. In the letter he mentioned that he’d like a bear to come out and ask a question about Berkshire. Now, I am not short Berkshire (as Mr. Buffett prefers his questioner to be), but I do not own Berkshire stock for one primary reason – the company, in my opinion, increasingly looks like an index fund with greater specific company risk.

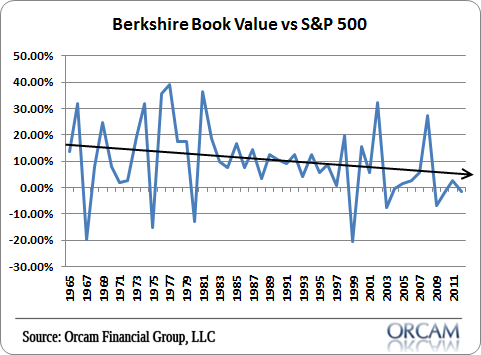

For instance, if you look at Berkshire’s book value relative to the S&P 500 we’ve seen a clear diminishing return. In the first 20 years of the firm’s lifetime the relative return was +13.97%. Over the course of the firm’s existence it’s been a more modest (but still impressive) 9.8%. Things start to get more interesting as the firm grows from a modestly sized firm to one of the largest market caps in the world. In the last 20 years the firm has averaged just 5.6% relative outperformance. In the last 10 years that number falls to 4.8%. And in the last 5 years the firm has averaged just 3.9%.

In other words, as the firm is getting larger and finding more “elephants” they are becoming more and more like the market. Obviously, the firm isn’t getting any smaller and Mr. Buffett’s plan to look for more “elephants” will only make the company more closely resemble the market.

I’ve referred to Berkshire as a multi-strategy hedge fund in the past. And it’s not surprising to me that Berkshire is displaying a trend that I recently began to notice during the course of my portfolio reviews with clients. Many of the funds investors own are former high flyers. They’re funds that performed well during the first part of their existence, but have more closely resembled an alpha drag in recent years. Berkshire is obviously a bit different than most of these funds, but I would be seriously concerned about diminishing rates of returns going forward as Berkshire gets larger and larger. This isn’t merely a recent trend, it’s a sustained multi-decade trend that will only become more apparent as the firm grows.

So, I have to wonder – how can a firm as large as Berkshire expect to outperform the S&P 500 to a degree that outweighs the many risks of owning a single holding company?

(Chart via Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.