Needless to say, last Thursday was nothing short of an orgasmic day for Gold bears and Dollar bulls. The precious metals complex crumbled along with the Euro, while the greenback was higher. In fact, it was such a bad day that Gold officially lost its safe-haven status, according to CNBC[1]. This was also noted by Elliot Wave[2] and The Business Insider[3]. All proclaimed that Gold was no safe haven.

In today’s world, how can you blame them? With the resurgence of day trading and most professionals staring at a computer screen all day, most people are worried about what is going to happen in the next hour, much less the next week or month. Everyone is now a trader, but not an investor. Who can remember the trends of the past quarter or year? Apparently, not CNBC, Elliot Wave and the Business Insider.

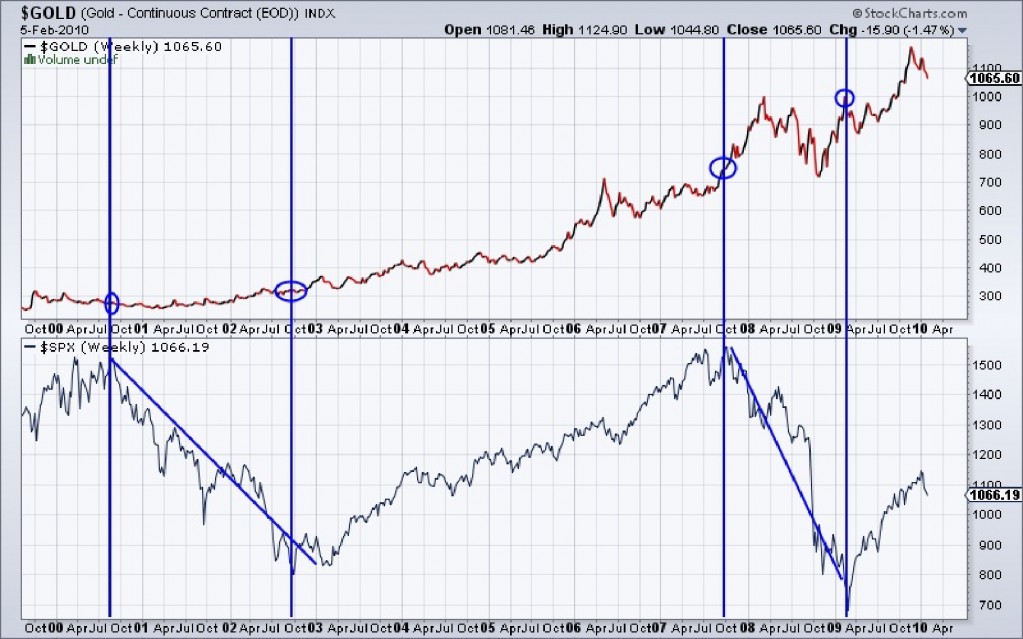

Not only has Gold been an excellent hedge for the entire decade (and it was in the 1970s), it rose in value during both of the bear markets in stocks. To those with a time horizon beyond a few nanoseconds, this chart is no surprise.

Meanwhile we hear from the bears that Gold is a “crowded trade” and that because there are a few commercials on television, the public is involved. Such anecdotal evidence is easily refuted by facts.

First of all, only 0.7% of all global assets are in Gold and gold-related equities and exchange traded funds[4]. What does a real Gold bubble look like? That figure was 15% in 1934 and 29% in 1980. While more and more people are buying Gold (that is what happens in a secular bull market, participation rises over time!), it is still extremely under-owned while corporate and government bonds are over-owned. The vast majority of the few that own precious metals in their portfolio have a weighting below 10%. While a lot of money poured into Gold in 2008 and 2009, even more money poured into Bond funds. That is the crowded trade.

Secondly, take a look at this chart (with my annotations) from https://www.sentimentrader.com. Essentially, we see that the public’s view on Gold did not exceed 75% bulls as it did in 2006 and 2008. As Gold broke $1000, the public’s bullish appetite barely increased.

Many gold bears are deflationists. They argue that since all asset classes have trended together and trended against the US$, all fall in a deflationary period. This is the correct view when we look at very short periods of time like July to October 2008. However, in the larger picture Gold performs very well on a relative basis in a deflationary period. It outperforms as other asset classes tumble and more importantly, it is the first asset to recover. Many seem to forget that the entire precious metals sector performed very well from November 2008 to February 2009, while stocks continued to fall and commodities were trying to find a bottom.

Furthermore, the US dollar doesn’t have to decline for Gold to do well. Did you know that since the very end of 2004, the US$ is flat but Gold is up 143%? Since July 20, 2007, Gold is up 56% while the dollar is flat. Since early September 2008, Gold is up 35%, while the dollar is up 1%. The majority of deflationists have been dead wrong on Gold and will continue to be wrong. Give huge credit to those who have been right on deflation and Gold: Bob Hoye and Mike Shedlock.

Turning to the technical situation, we see that traders, who are being confused for real technicians, are bearish on Gold for the near term. Joe Terranova on CNBC’s Fast Money said that the long-term uptrend was broken and that people needed to reduce positions. To be fair, long-term for Fast Money may be just a few days. As we will show, the reality is that Gold has a super-bullish technical outlook. It is in the early stages of a parabolic rise.

In the 1970s, Gold began to go parabolic in the middle of 1979, almost 10 years into the bull market. The important breakout occurred in 1978, and then corrected 20% back just below the breakout point (see the circle). This time around, the important breakout occurred at the end of 2007 and then in 2008 we had the snapback to support, though the snapback was a large 34%. Note that in the last bull market the process of breakout, snapback and parabolic move took a year to develop, while this time it is taking about two years. That means this parabolic move will last longer.

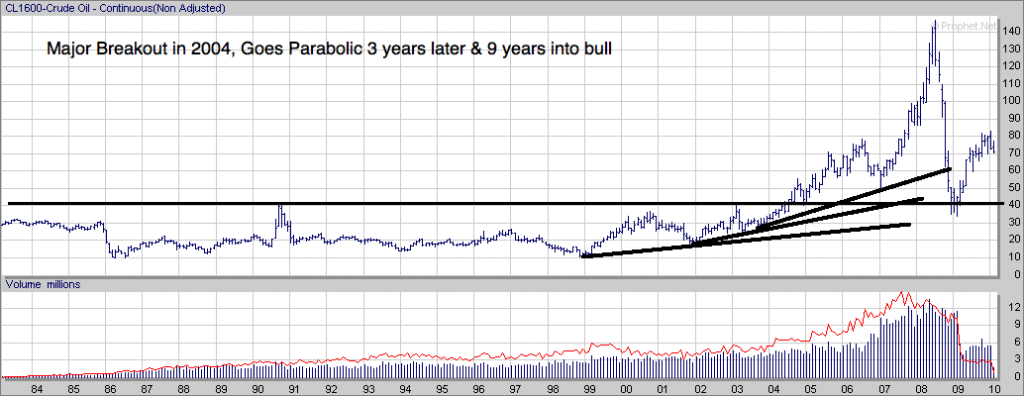

There are some distinct similarities with other bull markets. Look at Oil. Its major breakout occurred in 2004 and its parabolic move began about two and a half years later. The difference is Oil’s snapback to support didn’t occur right away. Its parabolic move began in the ninth year of that bull market.

The DJIA in the 1980s is a classic example. The major breakout occurred in 1983 and the parabolic move began two years later. If the bull market began in 1975, then the parabolic move began 11 years into the bull market.

Take a look again at the Gold chart and you will notice that the parabolic move has already begun. The recognition phase likely will take some time to develop. While Gold could move to $1300 in the spring, we don’t expect sustained new highs until later this year.

The fundamentals support our view as the financial crisis is entering the most bullish phase for Gold. The sovereign debt crisis, which really began in Iceland, will plague Europe this year and eventually spread to the UK and US by early 2011. Nations have no other choice but to monetize their growing obligations while trying to stimulate their economies with deficit spending and near 0% interest rates. It is a perfect storm for Gold as everything is lining up now for such a storm to begin in late 2010 and early 2011.

In closing, the huge winners will be Silver and the emerging Gold & Silver junior producers and explorers. For those looking to take advantage of a historic wealth building opportunity, visit https://www.thedailygold.com/newsletter and consider how we could help you ride this extremely volatile uptrend.

[1] https://finance.yahoo.com/news/Gold-Loses-SafeHaven-Status-cnbc-1840648925.html?x=0&sec=topStories&pos=6&asset=&ccode

[2] https://www.elliottwave.com/freeupdates/archives/2010/02/04/Gold-Prices-In-Free-Fall-Safe-Haven-My-Asparagus-.aspx

[3] https://www.businessinsider.com/its-a-good-thing-youre-hedged-with-gold-2010-2

[4] https://thedailygold.com/chartstechnicals/gold-is-0-7-of-global-managed-assets/?p=887/

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.