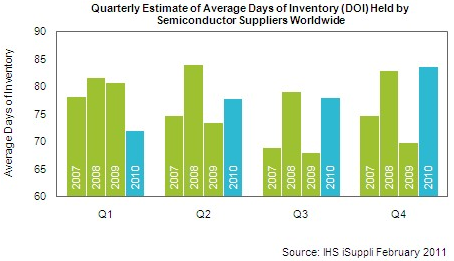

Technology has been the darling of the recent stock market rally, however, there are some signs that the strength in tech could be getting ahead of itself. Semiconductors, notoriously sensitive to the business cycle, are beginning to show some warning signs. IHS reported last week that semiconductor suppliers have near record days of inventory (Via IHS Isuppli):

Global inventories held by semiconductor suppliers surged to their highest level in two-and-a-half years during the fourth quarter of 2010, a development that could spell trouble if chip industry growth loses steam this year, new IHS iSuppli research indicates.

Semiconductor suppliers had 83.6 days of inventory (DOI) at the end of the fourth quarter of 2010, up 5.5 days, or 7 percent, from 78.1 days in the previous quarter. Inventory was at its highest level since the second quarter of 2008—right before the onset of the last semiconductor downturn—when DOI reached 84 days.

“Inventory levels arguably now are high by any standard, illustrating the difficulty of controlling chip stockpiles even with semiconductor suppliers’ arduous efforts to keep them in check,” said Sharon Stiefel, analyst, semiconductor market intelligence, at IHS. “The sharp increase of semiconductor inventory during the fourth quarter defied expectations of a decline for the period. This inflated level of inventory could become a concern if semiconductor industry growth falls short of expectations in 2011.”

Source: IHS

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.