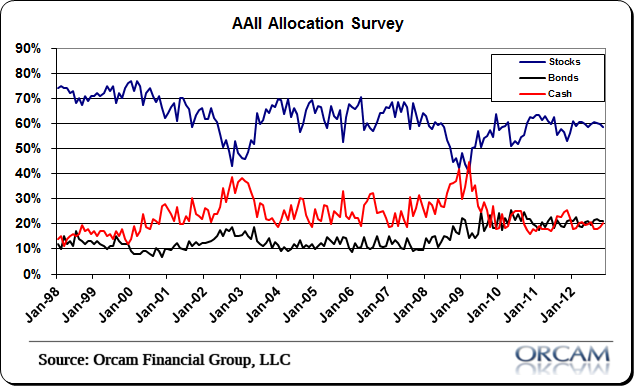

Here’s the monthly AAII survey for small investor portfolio allocations. The survey is showing the lowest equity allocation in 2012 which is inconsistent with the short-term AAII sentiment survey (click here) which is showing the highest level of optimism since earlier this year. Here’s more via Charles Robtlut at AAII:

“Equity allocations fell to their lowest level of the year as individual investors boosted their cash allocations, according to the latest AAII Asset Allocation Survey.

Stock and stock fund allocations fell 2.5 percentage points to 58.6%. This is the lowest allocation to equity investment since December 2011. It is also the third consecutive month AAII members have reduced their exposure to stocks and stock funds. The historical average is 60%.

Bond and bond fund allocations declined 0.1 percentage points to 21.2%. This is a four-month low for fixed-income allocations. Even with the decrease, November was the 41st consecutive month that fixed-income allocations were above their historical average of 16%.

Cash allocations rose 1.3 percentage points to 20.2%. This is the largest percentage allocated to cash since July 2012. Even with the increase, cash allocations were below their historical average of 24% for the 12th consecutive month.

Optimism about the short-term direction of stock prices remained below its historical average for much of November. Though many of our members take a longer-term outlook when it comes to allocating their portfolios, it is possible that the combination of short-term worries about the direction of stock prices and the uncertainty of the 2013 tax outlook prompted some AAII members to increase their cash levels. Low bond yields and interest rates continue to be problematic for investors who depend on portfolio income.

November’s special question asked retired AAII members how they are funding their retirement withdrawals. Many respondents said they use a combination of dividend income, bond interest and capital gains. Slightly more than a third of all respondents said they use dividend income to fund their withdrawals. Roughly one-quarter said they rely on capital gains and a nearly equal number said they use bond interest.

November Asset Allocation Survey results:

- · Stocks and Stock Funds: 58.6%, down 1.3 percentage points

- · Bonds and Bond Funds: 21.2%, down 0.1 percentage points

- · Cash: 20.2%, up 1.3 percentage points

November Asset Allocation Survey details:

- · Stocks: 28.8%, down 2.5 percentage points

- · Stock Funds: 29.8%, up 1.2 percentage points

- · Bonds: 4.3%, down 0.3 percentage points

- · Bond Funds: 17.0%, up 0.2 percentage points

Historical Averages

- Stocks/Stock Funds: 60%

- Bonds/Bond Funds: 16%

- Cash: 24%

The AAII Asset Allocation Survey has been conducted monthly since November 1987 and asks AAII members what percentage of their portfolios are allocated to stocks, stock funds, bonds, bond funds and cash. The survey and its results are available online at https://www.aaii.com/assetallocationsurvey.”

(Chart via Orcam Investment Research)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.