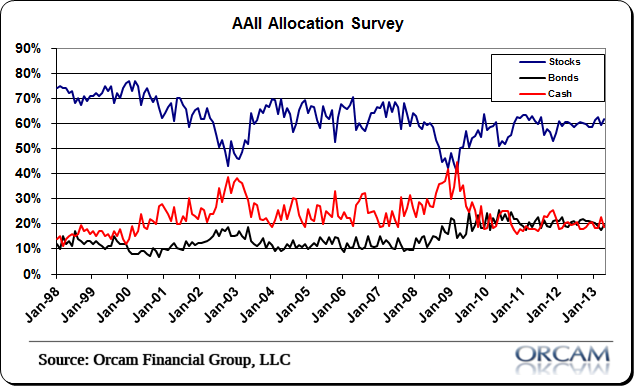

The latest AAII asset allocation survey showed that individual investors increased their equity holdings by 2.2%, increased fixed income exposure by 2% and reduced cash by 4.3%. That’s a meaningful swing in cash levels and shows how desperate small investors are to put some money to work. The current equity levels show that individual investors are still not completely sold on the rally as the historical average equity allocation is 60% while the latest reading brings us up to 61.7%.

Here’s more via AAII:

This month’s special question asked AAII members what would prompt them to increase their allocations to stocks. Approximately 27% said they were looking for a drop in stock prices, with many saying they were looking for a drop of greater than 10%. Another 25% said there was no catalyst that would cause them to increase their equity allocation. A sizeable portion of respondents in this group listed their satisfaction with their current portfolio allocation as the reason why. The next largest group, representing 7.5% of respondents, said better economic growth would cause them to buy more stocks. A small number listed their age as the reason why they are allocating more to equities, but indicated they would buy more stocks if they were younger.

Here is a sampling of the responses:

- “I am waiting for a correction. Most quality stocks look overvalued to me.”

- “After a large correction of 10% or more, I would allocate a large percentage of my cash to stocks and stock ETFs.”

- “Nothing. I have an asset allocation plan and I am not deviating from it.”

- “Nothing. I believe my current allocation is the maximum appropriate allocation for my and my wife’s age.”

- “For me to be 10 years younger and further from retirement, which is not likely to happen.”

- “Convincing my wife that we should change our allocation to reduce the bond component. I have been unsuccessful so far.”

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.