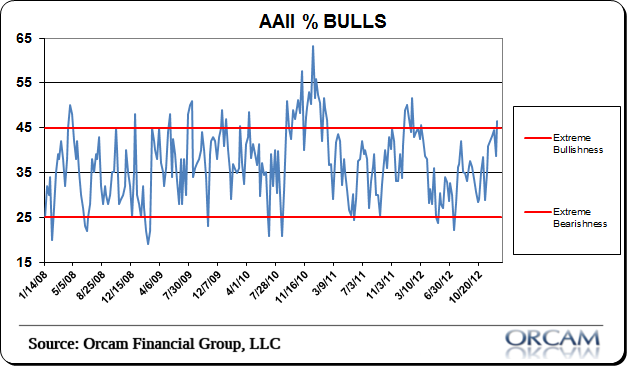

Small investors are getting very bullish on the equity market again. The latest reading from AAII showed the highest level of small investor sentiment since December which was the highest sentiment reading since early 2012. As you can see in the chart below, this puts us above the “extreme bullishness” range that has typically been consistent with a risk equity market environment.

AAII has more details here:

Optimism rebounded strongly, as pessimism dropped in the latest AAII Sentiment Survey.

Bullish sentiment, expectations that stock prices will rise over the next six months, jumped 7.7 percentage points to 46.4%. This matches the short-term high set on December 20, 2012. Bullish sentiment is also above its historical average of 39% for the sixth time in seven weeks.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, increased 1.5 percentage points to 26.6%. Even with the improvement, neutral sentiment is below its historical average of 30.5% for the 13th consecutive week.

Bearish sentiment, expectations that stock prices will fall over the next six months, fell 9.3 percentage points to 26.9%. Though the magnitude of the increase is steep, it only puts pessimism at a three-week low. Bearish sentiment is also below its historical average of 30.5% for the fourth time in five weeks.

At current levels, both bullish and bearish sentiment are within their typical historical ranges.

The resolution to the tax policy portion of the fiscal cliff has removed some of the uncertainty that individual investors were facing. Higher stock prices, monetary stimulus, continued economic growth, seasonality and a lack of negative headlines are also playing a role.

This week’s AAII Sentiment Survey results:

· Bullish: 46.4%, up 7.7 percentage points

· Neutral: 26.6%, up 1.5 percentage points

· Bearish: 26.9%, down 9.3 percentage points

Historical averages:

· Bullish: 39.0%

· Neutral: 30.5%

· Bearish: 30.5%

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.