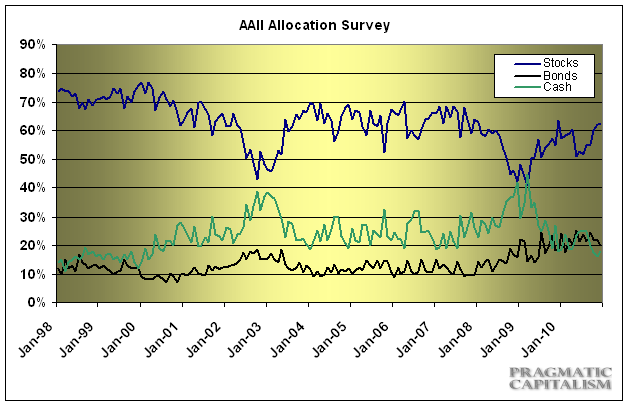

Small investors continued to migrate out of bonds, but did not move into equities according to the latest AAII allocation survey. Total equity allocations declined a bit on the month and are 2.2% above the historical average of 60%. Despite being above average, equity allocations are still well shy of the 70%+ range that is consistent with past secular market peaks. Bond allocations declined to 20% – the third straight month of bond allocation reduction. The winner this month was cash which saw a 1.9% increase.

Charles Rotblut of AAII elaborated on the data:

“Individual investors kept their portfolio allocations to equities essentially unchanged last month, according to the latest AAII Asset Allocation Survey. Stock and stock mutual fund allocations were 62.2% in December. The historical average is 60%.

Bond allocations fell for a third consecutive month. Individual investors held 20% of their portfolios in bonds and bond funds in December, a 1.8 percentage-point decline from November. This is the smallest allocation to fixed income since February 2010. The historical average is 15%.

Cash allocations rebounded by 1.9 percentage points to 17.8%. Despite the increase, cash allocations are merely at a three-month high. The historical average is 20%.

Though individual investors are bullish about the six-month and full-year outlook for stocks, they did not increase their portfolio allocations to equities. This may partially be due to the fact that some AAII members have already shifted their allocations, particularly from bonds to dividend-yielding stocks.

This month’s special question asked AAII members which asset class will perform best in 2011: large-cap stocks, small-cap stocks, international stocks, Treasuries, corporate bonds or precious metals. Respondents said that large-cap and small-cap stocks should deliver the highest total returns, with both asset classes receiving similar numbers of votes. International stocks were also picked by many investors. Bonds, both corporate and Treasuries, received very few votes.”

Source: AAII

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.