The various Fed banks are big fans of event studies. They like to take one or two day events and extrapolate out to make very broad conclusions about Fed policy and its impacts on various asset classes. Of course, this is incredibly flawed because markets are complex and dynamic. They are not the efficient systems we have all been taught about. Anyone who understands the complexity of price discovery can see how flawed these event studies are, however, common sense never stopped the Fed from making bad decisions. These studies were the basic premise of the Brian Sack paper on LSAP and the impact of QE1 as well as the recent SF Fed paper absolving the Fed of having any impact on commodity prices.

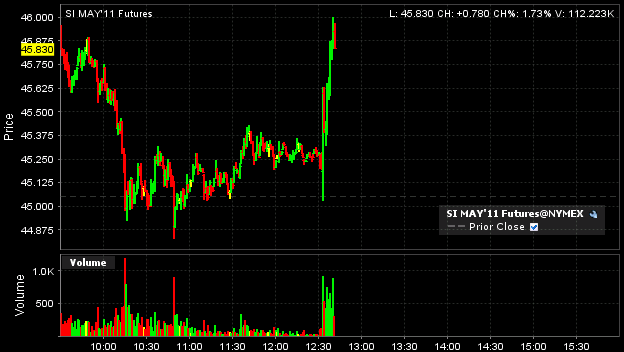

With that said, I just can’t help but laugh as various commodity prices ramp higher in the moments following the FOMC decision. This can best be seen in the 2% 15 minute move in silver prices. As the Fed foreshadows a continuing accommodative stance commodities rallied across the board. This is not surprising at all. This has been the story since QE2 started.

So, will I use this event to extrapolate out and make very broad conclusions? Why not? We all know industrial production didn’t just spike 2% in the last 15 minutes. And we all know that traders and speculators have been making massive bets on various assets due to Fed policy. So, is the Fed having an impact on commodities and other assets? I certainly think so and the BOJ certainly thinks so. And if you want to deny the impact you might also want to close your eyes so you cannot see the following chart. After all, what you can’t see can’t hurt you – or can it? Ignorance & biases not good excuses for bad policy….

* Mr. Roche is net short silver.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.