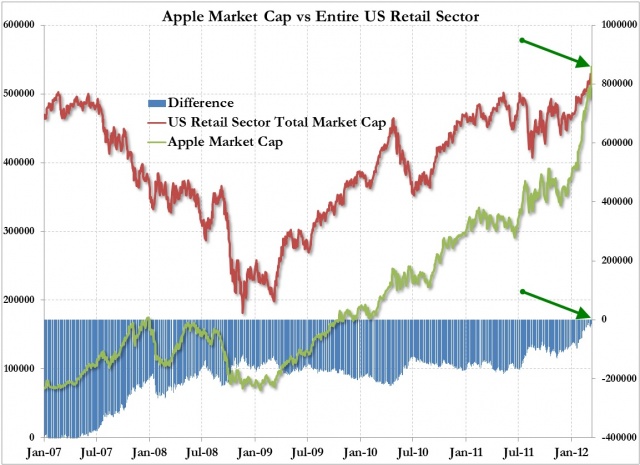

File this one under the “check back in 10 years” folder. This is a stat that will blow your mind. Apple’s market cap is now bigger than the ENTIRE U.S. retail sector. Now, I wouldn’t short AAPL in a million years, but these are the sorts of crazy stats that make you think “hmmm, is this really sustainable?” Here’s more via CultofMac & Jim Cramer:

“Add this to your list of things Apple is worth more than. As the Zero Hedge blog notes, “A company whose value is dependent on the continued success of two key products, now has a larger market capitalization (at $542 billion), than the entire US retail sector (as defined by the S&P 500).” Nuff said.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.