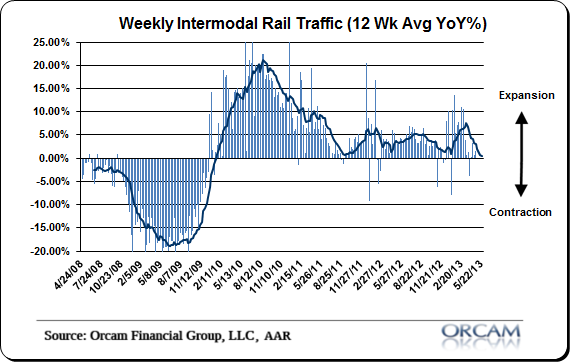

April rail trends finished with a whimper as intermodal rail traffic came in at 1.6% on a year over year basis. This continues a series of weakening data points as the Q2 period begins. After a very healthy 3 month average reading of 5.3% in Q1, the second quarter is off to a very sluggish start with a 0.38% average reading. The most recent reading brings the 12 week trailing average to 3.54% which is the weakest reading since January.

Here’s more from AAR:

“The Association of American Railroads (AAR) today reported that U.S. monthly rail traffic showed mixed results in April 2013, and traffic was also mixed for the week ending April 27, 2013.

Intermodal traffic in April 2013 totaled 962,019 containers and trailers, up 1.6 percent (15,053 units) compared with April 2012. April’s weekly average of trailers and containers, 240,505, was the highest for any April in history.

Carloads originated in April 2013 totaled 1,108,722, down 0.4 percent (4,640 carloads) compared with the same month last year.

Nine of the 20 major commodity categories tracked on a monthly basis by AAR saw year-over-year increases in April 2013 over April 2012. Commodities with the biggest carload increases in April included petroleum and petroleum products, up 46.4 percent or 17,524 carloads; crushed stone, gravel and sand, up 11.5 percent or 8,959 carloads; motor vehicles and parts, up 5.9 percent or 3,868 carloads; and coke, up 10.1 percent or 1,359 carloads.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.