One of the most important concepts I harp on in my book is the concept of savings versus investment. When you develop a sound understanding of the monetary system and the capital structure it becomes clear that the way we use these terms on a daily basis is not totally accurate. In fact, what we think of as our “investments” is really part of our “savings”.

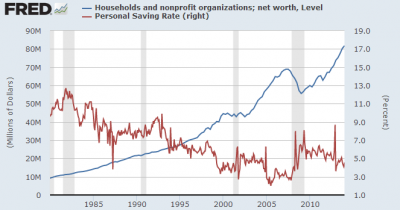

I bring this up because Ben Carlson has a smart post on his site about the relationship between asset prices and savings. And what’s interesting is that as asset prices increase we also tend to see a decline in the personal savings rate. I’ve reconstructed this view in the chart below showing household net worth relative to the personal savings rate:

What’s most interesting about this is the perverse sort of nature driving this trend. In essence, asset prices should improve as the economy improves and so we bid up prices because we think they’re worth more. But this “wealth” is largely paper wealth. It’s unrealized even though it’s right there in our accounting statements. So we feel wealthier. Indeed, we feel like we have more savings. But it’s largely just paper gains and not realized. So you get this inherent fragility built into a financial system where people could actually begin to spend well beyond their means just because they think they’re wealthier than they might really be.

This phenomenon explains why the housing bust was so important to understanding the great financial crisis and also explains why the Fed is so hypersensitive about stock prices. With the personal savings rate so low the economy has become that much more dependent on the unrealized value of financial assets. Which is great so long as the values are high and rising….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.