We humans are a fickle bunch. If there’s one thing you can pretty much guarantee, it’s that things are never really good enough. We seem to focus excessively on the negatives in our lives at all times. You’ve probably heard a lot about this in recent years about how the economy is terrible, how we’re in a “depression” or how we’re right on the verge of sinking into the abyss that we came close to falling into in 2008. This isn’t all an exaggeration. But a lot of the focus on the negative seems to be the result of a natural bias of ours – negativity basis. And it can be extremely destructive if it’s not understood.

Negativity bias is the tendency to emphasize and recall negative events relative to positive events. That is, fear of bad events plays a much more substantial role in our thought processes than positive events. This bias was discussed in some detail in a 2001 study in the Review of General Psychology in a study titled “Bad is Stronger than Good”. It’s a natural evolutionary bias – we fear that which can harm us. And when it comes to financial markets and economics we tend to see this bias in spades. Just look at the last 5 years of economic recovery during which negativity seems to have swept over the economic outlook with alarming regularity. But how bad has this recovery really been relative to past recoveries?

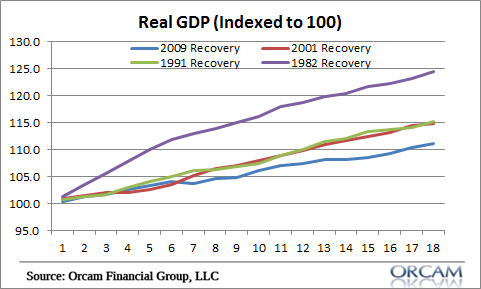

If we look at some of the broader indicators we can get a better grasp of the overall picture here. For instance, if we look at real GDP the data looks pretty weak, but not exactly a nightmare:

(Real GDP – Quarters Since Trough)

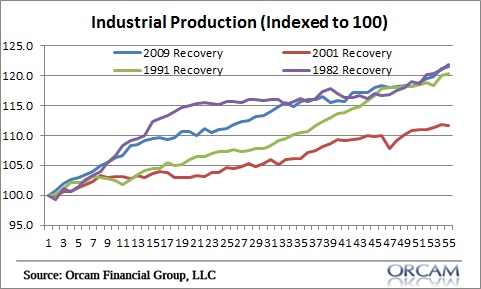

What about industrial production? The 2009 recovery actually ranks up there with the past three recoveries. In fact, it looks extremely strong:

(Industrial Production – Months Since Trough)

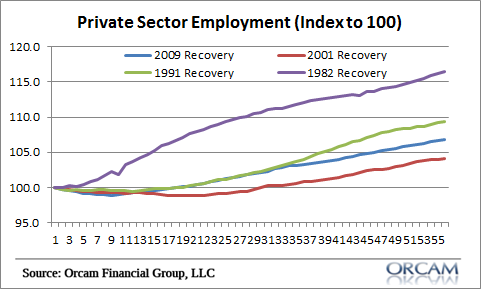

What about private sector employment? The 2009 recovery is middle of the road (bear in mind that almost all of the employment weakness in the last 5 years has been the result of government job cuts as I discussed here):

(Private Sector Employment – Months Since Trough)

This doesn’t tell the most amazing story in the world. It’s all certainly consistent with the “muddle through” theme I’ve been working with for the last 3-4 years. But it’s also not the nightmare that the mainstream media and doom and gloomers sometimes imply. In fact, there’s a fair amount of good stuff that’s gone on in the last 5 years. And one can only imagine how much better things might have been had the policy response not been so underwhelming and misguided at times. But I digress.

The point is, it’s a good thing that we often focus on the negatives in our world. That makes us more likely to make improvements, resolve problems and avoid the same problems in the future. But when we analyze the current state of affairs we have to also avoid falling victim to our negativity bias. An excessive focus on the negatives in our financial markets will generally lead one to fall into the trap of believing that things are actually much worse than they really are. And that can lead to very bad decisions. Instead, it’s better to understand this bias and try to analyze the economy and the financial markets with a more balanced and pragmatic perspective. That will help you understand the problems we face without falling into the trap of focusing so much on the negatives that you wind up thinking that the end of the world is always around the corner.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.