Business Insider ran a good piece yesterday discussing the most under appreciated risk in the markets as highlighted by Bank of America analysts. They said:

“The one risk that appears to us under appreciated by investors is the risk of higher oil prices – mentioned by only 6% of investors as a major concern – especially as there are significant risks of an escalation of the geopolitical situation in the Middle East.

Although tighter sanctions and the blockade of crude exports from Iran have reduced the country’s oil exports, Iran is still OPEC’s fourth largest oil producer, exporting about 1 million barrels a day. According to Commodity Strategist Francisco Blanch, a full blown Iranian oil supply disruption could push Brent oil prices up by $20-40/bbl and have twice the impact of Libya on global supplies and prices.

Indeed, the potential fallout from an Iranian strike could be much, much greater given that the oil market is already tight and that 20% of the world’s oil is transported through the Strait of Hormuz. A sustained rise in oil prices above $150/bbl would likely result in a recession and necessitate a significantly more defensive asset allocation.”

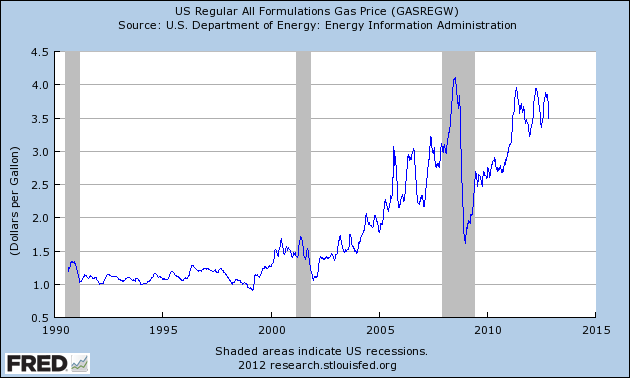

With all the attention on the election and the fiscal cliff you probably didn’t notice that oil prices remain right near their all-time highs:

Why does it matter? Bloomberg explained earlier this year:

“Since the U.S. still relies on imported fossil fuel, it is exposed to the volatility of oil prices, and sudden spikes can hit consumers hard and slow domestic growth. In 2011 Deutsche Bank estimated that a 1 cent-per-gallon increase in the price of gas translates to a $1 billion increase in household energy spending — money that consumers would otherwise be spending on other goods and services. Put another way, a sustained increase in the price of gas to $5 per gallon — an unlikely prospect, according to most analysts — would wipe out almost half of the 2.2 percent GDP growth projected by economists for 2012.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.