Well, here was one of the more predictable outcomes from the low and negative interest rate environment that’s been implemented – banks are now officially passing on the added interest costs to consumers:

“Some banks, including J.P. Morgan and Bank of New York Mellon Corp., have also started charging institutional clients fees to hold euro deposits, mainly driven by the European Central Bank’s move to make firms pay to park their cash with the ECB. BNY Mellon recently started charging 0.2% on euro deposits. State Street Corp. said in its third-quarter earnings call in October that it planned to begin charging fees later this year on euro deposits.”

This isn’t remotely surprising. I said this would happen before the policy was implemented:

“This doesn’t mean lending rates or other bank costs won’t increase though. In fact, as this negative rate acts as a direct tax on banks it’s very likely that they will simply try to pass the cost on to consumers.”

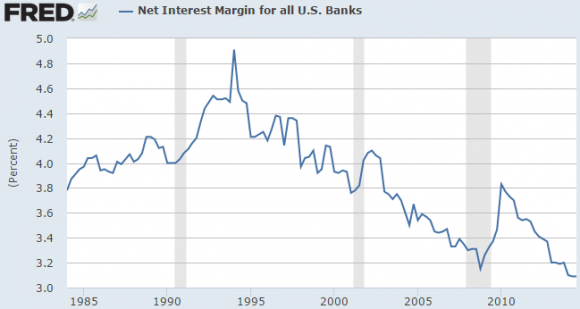

As net interest margins plummet thanks to the low demand for debt and low interest rate environment the banks are looking for any way to boost their spread on assets and liabilities.

Unfortunately, negative interest rate policies like the one recently implemented by the ECB will just act like a tax on consumers because the banks will inevitably be forced to pass on the costs to consumers. In the aggregate, banks can’t force depositors to hold fewer deposits than they want so this turns into a game of hot potato where banks charge customers for deposits until the deposits move to some other bank that causes the same problems for a different bank.

But there’s a bigger problem in all of this. Charging negative interest rates can’t increase the demand for loans. So the only way banks are likely to increase their lending as a result of this type of policy is by reducing their lending standards. This means that banks are not only taxing their customers in new ways, but they are also likely to reduce lending standards in an effort to make more loans and boost profitability.

This negative interest rate thinking is all supply side economics promoted by people who don’t understand proper banking dynamics and have generally poor conceptualization of risk management. It’s a very strange policy to continue with.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.