We get initial estimates for Q4 GDP tomorrow and analysts expect a 3.5% print. That sounds nice, but given recent economic data it might be on the low end. Joe Lavorgna of Deutsche Bank is right in-line with estimates, but provides some color (via Business Insider):

“We expect today’s Q4 real GDP release to show a 3.5% annualized gain, although the underbelly of the report will likely be even stronger with final sales poised to grow at the fastest pace in nearly five years. No doubt, a mix shift away from inventory investment and toward final demand will give the economic expansion added sustenance. This positive momentum will be reinforced by extremely accommodative fiscal and monetary policy, which in turn causes us to question whether our forecast for 2011 real GDP is too conservative. Before the onset of the last recession, the dollar value of real GDP peaked at $13.364 trillion in Q4 2007. Based on our forecast of a 3.5% annualized gain in Q4 real GDP, the economy will surpass that level and rise to $13.394 trillion. This will officially place the economy in expansion mode. Much of the increase in output is coming through greater consumption and business investment. We estimate real consumer spending grew 4.5% last quarter, led by a massive 23% increase in durable goods expenditures—predominantly coming from auto sales.

Spending on nondurable goods is expected to be up 4.0%, while spending on services should continue to lag, rising just 1.9% in the quarter. While a 4.5% gain in consumption would be the largest since Q1 2006 (+4.5%), we do not believe our forecast is aggressive since the level of real November consumer spending is already up 4.4% at an annualized rate relative to Q3. Another area of strength will likely be equipment and software spending, also known as capex. We are anticipating a record fifth consecutive double-digit gain in capex (+10.0%). A slowdown is highly unlikely given current tax policy.

The accelerated depreciation allowances for capex could add a couple of tenths to real GDP growth this year and next. Companies now have the ability to expense 100% of their capital expenditure this year and 50% next year. This is likely to pull some spending forward into this year and next, thereby lifting capex even more than what we anticipated before the passage of the fiscal stimulus bill. We could see a noticeable payback in capex in 2013, but it is too early in the cycle to fret slowing growth—particularly since consumer spending has yet to accelerate. Given solid gains in consumer and business spending, we estimate that final sales, measured as GDP less inventories, will rise a solid 5.3%. This would be the largest gain since Q1 2006 (5.9%) and would represent the third largest increase in final sales in the last 10 years. To be sure, it is a noticeable improvement from a 0.9% gain in Q3 2010 and an average increase of just 1.1% since the recession ended. Assuming productivity growth slows, which is a critical assumption of ours, then by definition accelerating domestic demand must be met through faster job creation. The risks are certainly tilting toward faster real GDP growth this year than we presently forecast, but we will need to see at least one outsized employment report before we consider altering our projections. This probably did not occur in January, since weather appears to be distorting much of the data.”

JP Morgan is a bit more sanguine:

“Real GDP is expected to have grown at an annualized rate of 2.9% in the fourth quarter of 2010. Although the headline reading would only be slightly higher than that reported for 3Q (2.6%), we expect the composition of the report to be more favorable, highlighted by the strongest growth in consumption in four years. Our forecast calls for the level of real GDP to finally eclipse the pre-crisis level reported for 2Q08 (the 3Q10 level was less than 1% below the pre-crisis level).

We forecast a 4.0% saar increase in real consumption in 4Q, which should lead final sales up 5.4% saar. The data on retail sales and auto sales looked strong in the fourth quarter, although much of this strength was concentrated early in the quarter. In the prior five quarters of the recovery, consumption has been very restrained, averaging only 1.9% saar growth, so the expected acceleration in spending would represent a welcome change.

We expect inventories to be a significant drag on the economy in 4Q after inventories increased a very strong annualized rate of $121.4 billion in the third quarter. We expect a much more modest pace of growth in 4Q ($41.2 billion) based on the inventory data available so far for the quarter, and this slowing should subtract 2.5%-pts from real GDP growth. The trade data available through November indicate that the trade balance narrowed markedly in 4Q—we forecast a narrowing of the trade balance from -$505.0 billion in 3Q to -$441.7 billion in 4Q. This should add 2.1%-pts to GDP growth—the first contribution from trade in one year.

The data on new housing activity have remained stuck at depressed levels since bottoming after the end of the homebuyer tax credit. We look for only a slight 3.0% saar move up in residential investment in 4Q after this component plunged 27.3% saar in 3Q following the tax credit’s expiration.

The price data available for the fourth quarter show that food and energy prices have picked up a bit, but core prices remain soft. We forecast 1.8% saar growth in the PCE price index for the quarter and a much softer 0.4% saar change in the core measure. We expect the GDP chain price index for 4Q to increase 1.1% saar.”

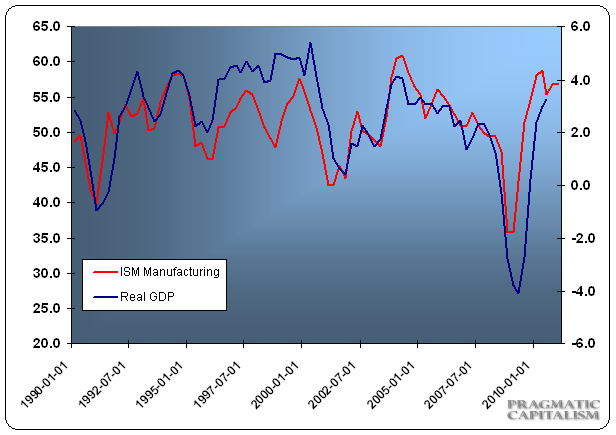

I think the analysts are low balling the estimates. Recent ISM Manufacturing reports are consistent with GDP in the ~4% range. I think that’s a fairly reasonable estimate and that we could see an even better figure in final sales. Recent PCE data and slight improvement in exports also confirm this. “Better than expected” has been the theme of the last 6 months and there’s nothing in the data that makes me think this report will be any different.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.