A prudent strategy note from the analysts at Credit Suisse. After the huge rally in equities over the last 6 months they believe upside could be more difficult to come by and that there is risk of downside in the short-term. Although they are still long-term bullish they recommend hedging in case of a correction. I agree with their sentiments and believe the note is a prudent tactical approach (via CS):

“Trend remains up; we expect dips to be modest; use to add exposure.

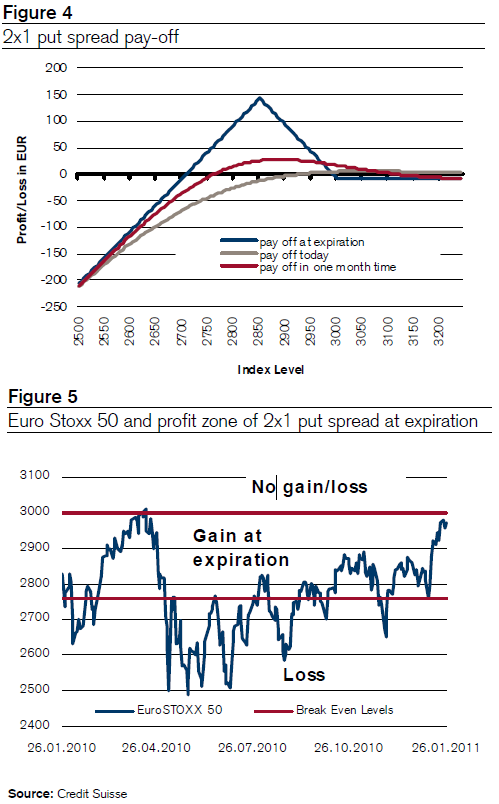

We maintain our strategic and tactical overweight on equities. After the strong YTD performance of the Euro Stoxx 50, a short-term setback cannot be ruled out but will likely be modest. For investors willing to position their portfolio for a moderate short-term drop in prices without giving up any upside participation, we recommend a fully funded 2×1 put spread.

The recommended 2×1 put spread consists of a long March 2011 put with a strike at 3000 (ATM) and two short March 2011 puts with a strike at 2850 that fully finance the long positions. No upfront costs occur, but we suggest keeping the potential value at risk in cash. We recommend a 10% position in our Research Weekly portfolio, consisting of the suggested cash and option positions.

If the index trades above the upper strike price, no loss or gain accrues. If the underlying trades between 2760 (–7.4% from current index level) and 3000 the strategy is profitable with a maximum profit of EUR 145 (4.8% of the current index level) if the index trades at 2850 at expiration. In case the index drops below the lower break even point, the strategy is fully exposed to downside.

The pay-off during the life of the options looks different than the pay-off at expiration. The maximum profit is only reached at expiration. The overall trade can be in negative territory during the life of the options even though the underlying trades between 2760 and 3000.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.