In 2008 Warren Buffett made a bet against hedge fund Protégé Partners. The bet was fairly simple. Protégé Partners could pick a group of hedge funds to perform against a simple S&P 500 index fund over the course of 10 years. Buffett bet $1 million that they couldn’t outperform the simple index.

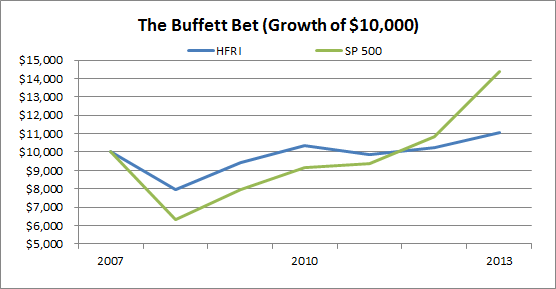

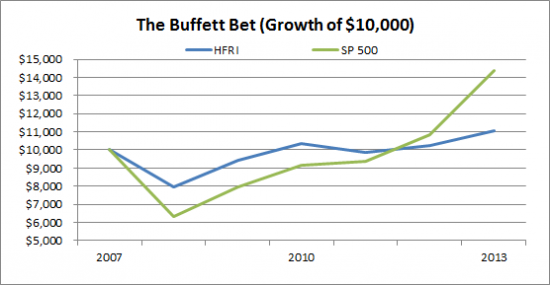

So, how’s that bet looking today? Not so good given the huge run in the S&P 500 in the last few years. According to Fortune the hedge funds have returned just 12.5% while the S&P 500 is up 43.8%. But it hasn’t always been that lop-sided. In fact, it looked pretty bad for Buffett in those first few years (I am just guessing that they’re using the HFRI since the HFRI just happens to also be up 12.5% since 2008):

This has the potential to look very bad for the hedge fund industry when all is said and done. And the weirdest part is that they didn’t even agree to risk adjust the returns, which is the whole point of the hedge funds in the first place! So, in essence, they made a bet that they would generate stable returns and that the stock market roller coaster ride would just so happen to be on its way down when the 10 year bet happened to be ending. They don’t even seem to have considered the fact that the S&P 500 was bound to be SUBSTANTIALLY more volatile than the HFRI. And not surprisingly, it’s been almost twice as volatile thus far. So that 43% looks good, but it doesn’t at all reflect the level of risk that’s being taken. And since the bet involves the nominal return at the end of 10 years, no one will care about this when and if the hedge funds lose. Which kind of defeats the whole point of the bet to begin with and will completely mislead the general public when the media inevitably runs with a story about how much better the index fund is than the hedge funds….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.