In my upcoming book on macro investing I focus a good deal on the need to maintain an optimistic outlook on the long-term macroeconomic forecast. Over the long-term, betting against human progress and innovation has been a very bad bet. And I doubt it’s about to become a good one any time soon because we seem to only be getting more productive and more advanced with every minute. This doesn’t mean you should be recklessly bullish, but it’s prudent to be a measured optimist. A little data will help put this in the right perspective.

Since 1855 the US economy has been in recession a full 30% of the time. In the post-war era since 1945 the US economy has been in recession 16.2% of the time. Since 1980 we have been in recession 14.6% of the time. Since the year 2000 we have been in recession 18.3% of the time. The flip side of course is that the economy has been in expansion 83.8% of the time since 1945, 85.4% of the time since 1980 and 81.7% since 2000. Betting on recessions is usually a very bad bet and that means the economy is generally expanding.

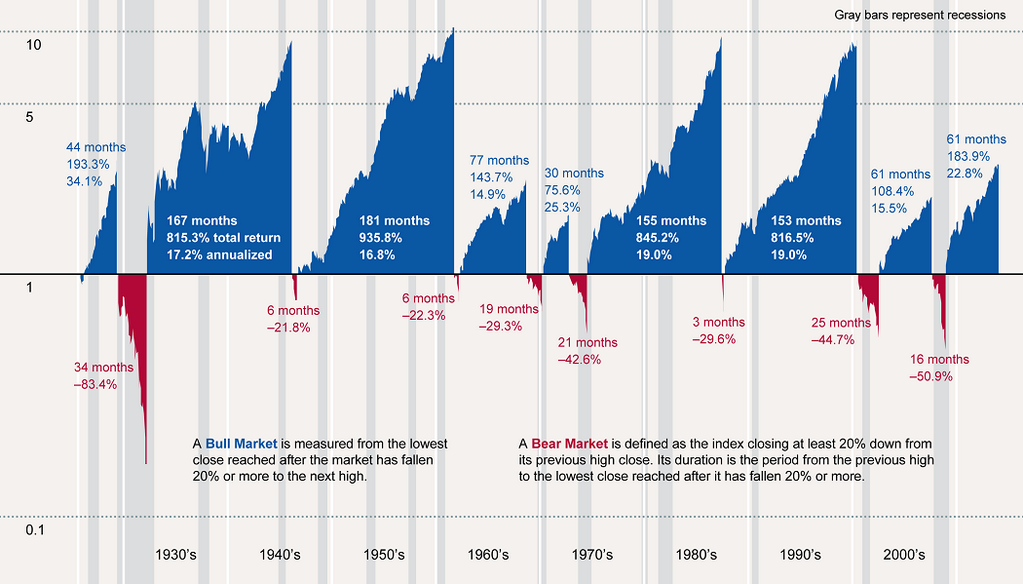

Now, the stock market is not the economy and while the market cycle tends to precede the economic cycle, the aforementioned trends aren’t that much different in the stock market. For further perspective, see this chart from Morningstar’s Jerry Kerns which shows bull markets and bear markets:

Once again, this looks like a trend you really don’t want to spend too much time betting against. Of course, this doesn’t mean it’s always silly to hedge or make negative bets on the market. And it certainly doesn’t mean it’s prudent to be a raging bull all the time. But it should put things in the right perspective over the long-term because being an overweight bear over the long-term is very likely to be a recipe for disaster.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.