By Charles Rotblut, CFA, AAII

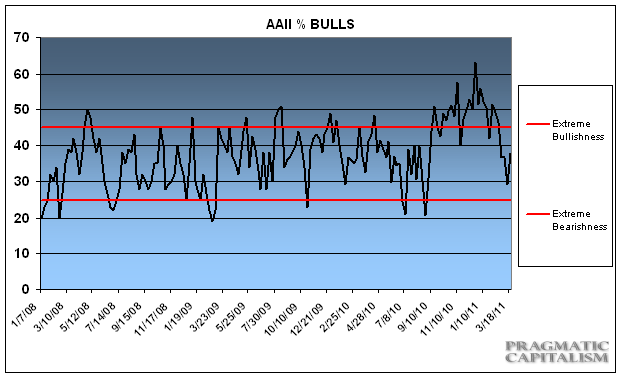

Bullish sentiment rebounded 9.2 percentage points to 37.7% in the latest AAII Sentiment Survey. This is a five-week high for optimism about the six-month direction of stock prices. Nevertheless, bullish sentiment continues to stay below its historical average of 39%.

(chart provided by pragcap.com)

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, fell 4.1 percentage points to 27.3%. The historical average is 31%.

Bearish sentiment, expectations that stock prices will fall over the next six months, declined 5.2 percentage points to 35.0%. Even with the pullback, bearish sentiment remained above its historical average of 30% for the fifth consecutive week.

The percentages of individual investors describing themselves as bullish or bearish remained close for the fourth time in five weeks. The lack of a clear signal is a reflection of the market’s recent volatility. Though this week’s rebound in stock prices helped restore some optimism, the latest survey results show that many AAII members continue to have cautious attitudes.

This week’s special question asked AAII members whether domestic or global/foreign issues were having a bigger impact on their sentiment. The responses were evenly split, with some members saying both domestic and international events were having an equal impact. Here is a sampling of the responses:

- “Domestic issues—I think our economy is coming back, and the various threats are not likely going to be strong enough to reverse this.”

- “It is the labor markets, housing and the lack of political will to reduce the budget and adopt policies to improve the economy.”

- “The financial markets in the European Union are a continuing threat to growth in the overall global economy.”

- “With the problems in the Middle East, the disaster in Japan, and our unstable economy, I see nothing but an unstable market.”

- “I am amazed at the resilience of the market given all of the bad news; it just keeps bobbing up like a cork.”

This week’s AAII Sentiment Survey results:

- Bullish: 37.7%, up 9.2 percentage points

- Neutral: 27.3% down 4.1 percentage points

- Bearish: 35.0%, down 5.2 percentage points

Historical averages:

- Bullish: 39%

- Neutral: 31%

- Bearish: 30%

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.