I always have a good chuckle when I look at analyst’s ratings on the broad market. I got an even better chuckle when I read this story from FactSet:

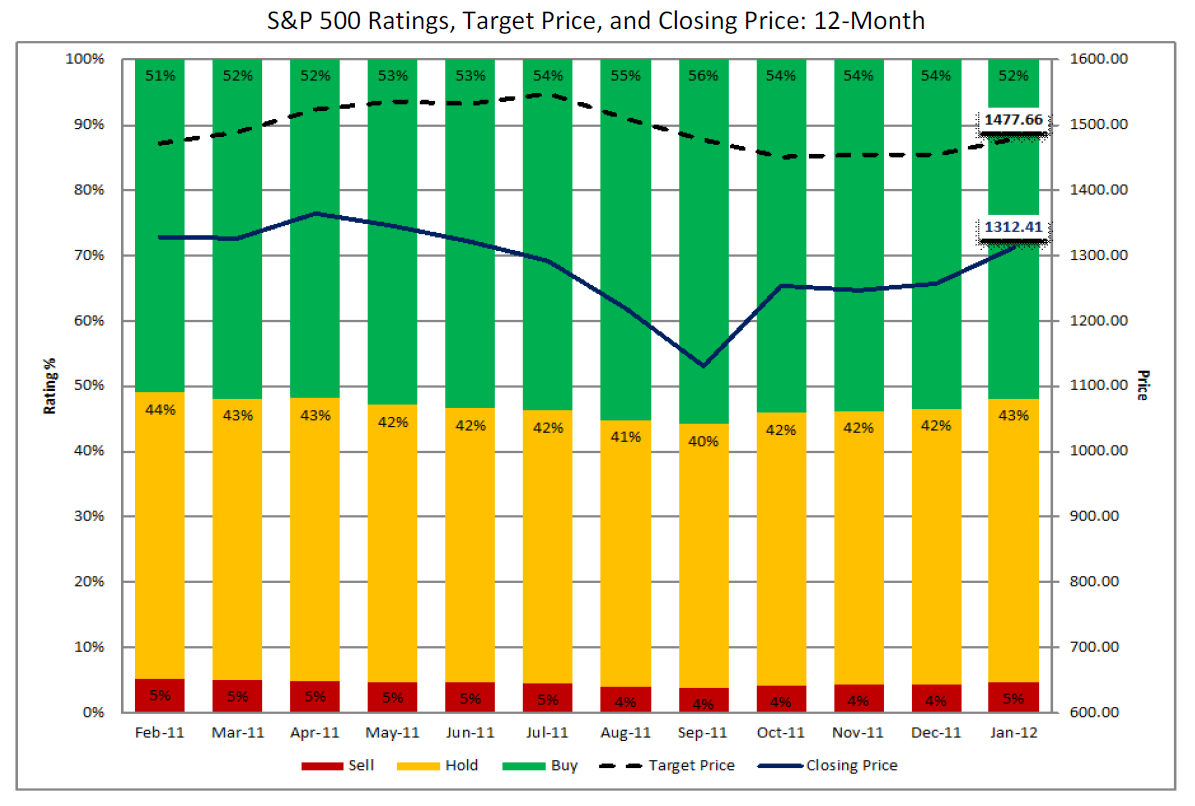

“Despite a 4.4% increase in the price of the S&P 500 over the past month, analysts have become more pessimistic on the market based on changes to their ratings since January 1. While the number of Buy ratings dipped slightly (-0.5%), the number of Hold ratings rose 6.3% and the number of Sell ratings jumped 13.2% during the month.

Overall, 52% of the ratings on companies in the S&P 500 were Buy ratings, 43% of the ratings were Hold ratings, and 5% of the ratings were Sell ratings. At the sector level, the Energy sector has the highest percentage of Buy ratings (64%), while the Utilities sector has the lowest percentage of Buy ratings (31%).”

Yes, can you feel the pessimism? That’s a whopping 1% rise in the number of sell calls. It never ceases to amaze me. I know how the Wall Street machine works and they need you in the game, but it drives me mad how analysts will always tell you when to get into a stock, but never have an exit strategy. I’ve made most of my money in stocks over the years by being a great seller. I’m a mediocre buyer. But I’m a great seller. I don’t know how any good investor can have one side of the coin without the other. And more often than not, I find that the people who are the greatest investors don’t just have an entrance strategy, but have the exit strategy mastered….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.