Scott Sumner has an interesting post up discussing the relationship between banks and the Fed stating the case (again) for why banks don’t really matter. Scott’s super nice so I hate to keep banging on this point (and him), but I feel like this is extremely important….We just fundamentally disagree on this and I’ll explain why.

The way I view our monetary system is through the banking system with the Fed as a facilitating entity to the banks. Most economists see it differently. They think that banks are basically the same thing they were under a gold standard where they held onto a certain amount of physical gold and then lent notes against those gold reserves. And when we went off the gold standard the government stated a certain “reserve requirement” and it looked like the government just swapped out gold for reserves and then banks started lending against their reserves. And the result of this economic myth is that almost all modern macro textbooks describe some version of the money multiplier or view of the world where the government has a sort of ironclad control over the “real” money supply. In other words, almost all modern economic schools start with the government and build a model of the world out from there. In doing so, they basically leave banks out of the story. I think it’s the wrong way to view the monetary system.

In my view, the banks rule the monetary roost. They dominate the form of modern medium of exchange by creating the thing we most transact with. They create deposits, which are, functionally, every bit as good as the monetary base (99.9% of the time). And I’d further argue that your bank deposits aren’t really a claim on the monetary base like your bank note was during the gold standard. In fact, almost all of us who are non-banks can’t even access reserve deposits (as they aren’t depositors in the Fed System) and the only way to access cash notes is to first open a bank account. So it makes no logical sense to claim that non-banks use deposits as mere claims on base money. From this, it starts to become clear that banks create the dominant money and that outside money (reserves, coins and cash) merely facilitates the use of inside bank money (see here for more on this).

Anyhow, the part about Scott’s post that bothered me was this:

“Banks can increase M1 by making it more attractive to hold demand deposits. They can pay interest on checking accounts, for example, or offer free services. That changes a real variable; DD/MB. But they cannot make the Fed print more money. That’s the key difference. The Fed can get the banks to create more deposits, but the banks can’t get the Fed to print more. The banks maximize profits while the Fed maximizes social welfare.”

First of all, if the central bank has set a reserve requirement and banks make new loans that result in the need for reserves then this simply results in an overdraft at the Fed. If the banking system needs reserves then the Fed supplies them as they are the monopoly supplier of reserves to the banking system. Of course, that’s not a concern today because the banking system is flooded with excess reserves, but in the pre-crisis era this overdraft function was very real and the Fed adhered to it just as it always adheres to its goal to maintain banking system stability. The Fed doesn’t impose rules on the banking system that it can’t possibly adhere to.

Further, the amount of cash that is supplied to the banking system is not really determined by the Fed. This, again, is a function of bank demand. The NY Fed explains (emphasis mine):

“Each of the 12 Federal Reserve Banks keeps an inventory of cash on hand to meet the needs of the depository institutions in its District. Extended custodial inventory sites in several continents promote the use of U.S. currency internationally, improve the collection of information on currency flows, and help local banks meet the public’s demand for U.S. currency. Additions to that supply come directly from the two divisions of the Treasury Department that produce the cash: the Bureau of Engraving and Printing, which prints currency, and the United States Mint, which makes coins. Most of the inventory consists of deposits by banks that had more cash than they needed to serve their customers and deposited the excess at the Fed to help meet their reserve requirements.”

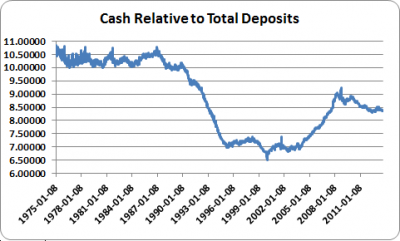

If the banking system needs cash the Fed supplies it to the banking system just like they would with reserves. The Fed does not fire Ben Franklin’s out the front door through a canon. As should be expected, if the banking system expands broad money then depositors access more cash. The ratio of currency to deposits has pretty much always been between 7-10%. But the demand for currency is not a function of some supply side mechanics at work within the Fed. It’s the result of broad money expansion and, as the NY Fed, states, “demand” from depositors.

The Fed operates to facilitate the “demand” of the entities it is there to serve. And that’s really what the Fed is. The Fed is there to serve the needs of a hugely important private banking system. So yes, the banking system most certainly can and does influence the monetary base. And understanding the hybrid nature of our monetary system means that banks AND central banks matter. Leaving one out of the monetary equation leaves you with a very narrow and flawed perception of the system as it presently exists.

NB – for clarity, I should say:

“Loans create deposits, which creates reserve requirements, with lags. The Fed supplies system reserves (pre-crisis) as the requirement comes into effect.

Therefore, there is no reason for an increase in required reserves to correlate with overdrafts.

Banks have all the information they need to anticipate bumps in their required reserves, due to the time lag. So they react to that just the way they would to any other cash requirement for normal banking purposes. The reserve supply is out there. They just have to get their share by attracting it in through their money market.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.