Over the last few years I’ve been fairly negative on the economy. I underestimated the effectiveness of the fiscal stimulus in 2009, but on the whole the economy has remained sluggish at best. Despite this, I’ve never swayed from the balance sheet recession approach which I first began using in 2008.

The theme has been generally consistent – in a balance sheet recession the government must step in and fill the spending void. This would create the mirage of a recovery, but it would help avoid something far more disastrous from developing. Underneath this mirage lies the balance sheet recession and she lurks to this day. That said, I’ve been deeply critical about the calls for austerity in the USA and the persistent calls by those who said hyperinflation was lurking or sudden rate surges were on the horizon (they were wrong). Luckily, we’ve been able to fend off the fearmongerers thus far. We even passed a payroll tax break (albeit a small one), but we largely offset it with the QE2 program (which I also said would fail with flying colors). So my euphoria over the tax cut was to be short lived. But in this disaster zone known as economic forecasting I’ve gotten the macro picture far more right than wrong.

I’ve previously discussed why I believe the balance sheet recession in the USA could end by 2013 or 2014. And now we’re beginning to get a clearer picture of what will come out of the debt ceiling debates. For now it doesn’t look like the cuts are likely to be as harsh as some might fear. But they’ll be a drag on the economy given the extraordinary stimulus we’ve seen in recent years and the continuing de-leveraging trend.

In a recent note Societe Generale analysts provided their baseline scenario:

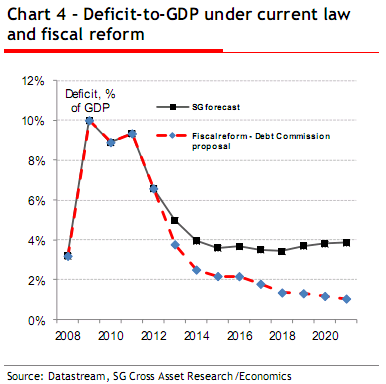

“Our baseline economic forecast for the US reflects policymakers continuing to raise the ceiling every time the country nears it, fearing the consequences if they do not. We have not factored in any austerity aside from the planned expiration of the 2010 fiscal stimulus package over the next two years. The political calendar, which has the 2012 elections on the near horizon, provides only a small window of opportunity to come to an agreement on a long-term deficit reduction plan. Under this baseline, the deficit-to-GDP ratio will shrink after this year, but begin to rise again later in the decade; while the debt-to-GDP ratio will continue to rise (see charts 4 and 5). See the table at the end of the document for more details on our US economic outlook.”

If we just assume that the recent current account trends continue (3-4% of GDP) and that SG’s baseline scenario is somewhat accurate we should expect government spending to become a major drag on economic growth in 2012. SG has a baseline growth rate of 3.5% in coming years. I’ll take the under on that. The dwindling fiscal stimulus is already creating drag in 2011 and the risk going forward certainly appears to be to the downside.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.