The monthly data on industrial production and capacity utilization always tells us a lot about the economy. The most important takeaway from this morning’s report is that there are no signs of recession in this data. The headline industrial production figure came in at 1.1% and the headline capacity utilization figure came in at 79.2. Neither point to recession.

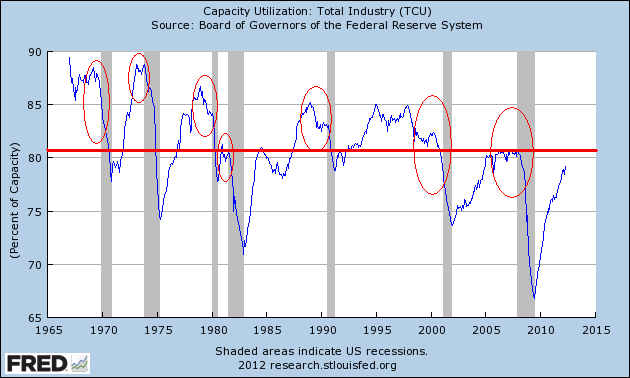

Now, if we back out and take a 30,000 foot view here we can put things in slightly better perspective. I’ve attached a chart of the TCU data going back to 1965. You can clearly see three things in this chart:

1) The US economy is operating well below capacity. The average TCU level of 81 during this period is still quarters if not years away from being achieved. This means the economy is still weak even if the trend is in the right direction.

2) This also tells us quite a bit about the inflation story. With an economy operating below capacity it’s unlikely that we’ll see high inflation.

3) Each of the 7 recessions displayed here were preceded by long periods of decline or stagnation in the TCU data. This doesn’t mean it’s impossible that a recession could begin soon, but this data certainly isn’t consistent with that view.

Given the substantial global headwinds that are developing currently, I am kind of laying my head on a slab by sticking with the “no recession” call that I’ve been making for a long time now. I’m making the forecasting mortal sin by giving you both a time and a prediction! Clearly, the risks are rising and the uncertainty surrounding the “fiscal cliff” is likely to exacerbate that. But I just don’t see recession in the USA for now. We’ll revisit this outlook in the coming quarters.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.