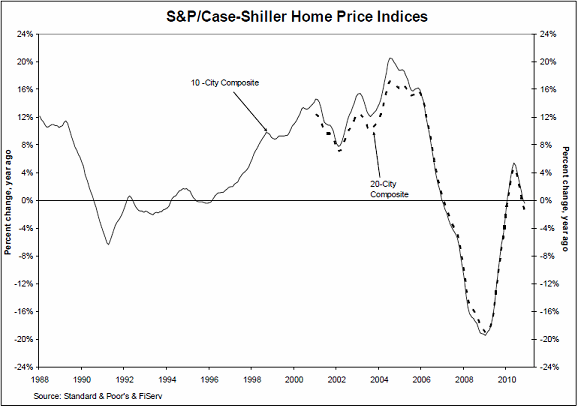

No real surprises here as the Case Shiller housing report shows continued declines in housing prices. The lack of government involvement, negative seasonal trends and generally poor fundamentals are resulting in continued home price declines throughout much of the country.

I don’t think this is any reason to panic, but it does increase the risk that the recovery could become increasingly fragile. For now, I am still expecting stabilization in the middle portion of 2011 and then a general stagnation in the market. The negative fundamentals combined with continuing consumer weakness should keep any substantive housing recovery from reemerging.

Early last year I expected home prices to decline anywhere from 7-15% further. Depending on the source, home prices have fallen 3-5% from those levels. It would not be surprising to see the market experience another 5% decline in the coming 12 months. Any exogenous shock to the economy would put downward pressure on these estimates.

From Case Shiller:

“With these numbers more analysts will be calling for a double-dip in home prices. Let’s take a moment to define a double-dip as seeing the 10- and 20-City Composites set new post-peak lows. The series are now only 4.8% and 3.3% above their April 2009 lows, suggesting that a double-dip could be confirmed before Spring. Certainly eight cities setting new lows, and with the only positive news concentrated in southern California and Washington DC, the data point to weakness in home prices,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “With an annual growth rate of +3.5% in November, Washington DC was the strongest market, but still well below the +7.7% annual rate of growth seen in May 2010. The only city with a gain in November was San Diego, up a scant 0.1%. While San Diego, Los Angeles and San Francisco are still ahead from November 2009, their annual rates are

shrinking in recent months.“Looking at the monthly statistics, 19 of 20 MSAs and both Composites were down in November over October. Fourteen MSAs and both composites have posted at least four consecutive months of decline with November’s report. Thirteen of the MSAs and the 20-City Composite fell by 1.0% or more in November. While not always consecutive months, 13 of the MSAs and both composites have posted at least seven months of decline since the beginning of 2010. These markets saw home prices fall more than half the months reported in 2010 so far.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.