The CBO has released their latest estimates for the budget deficit and the news is mixed. The good news is that the budget deficit is likely to stay large through 2012. The bad news is that it is expected to drop off “markedly” after that. They say:

“CBO projects a $1.1 trillion federal budget deficit for fiscal year 2012 if current laws remain unchanged. Measured as a share of the nation’s output (gross domestic product, or GDP), that shortfall of 7.0 percent is nearly 2 percentage points below the deficit recorded in 2011, but still higher than any deficit between 1947 and 2008. Over the next few years, projected deficits in CBO’s baseline decline markedly, dropping to under $200 billion and averaging 1.5 percent of GDP over the 2013–2022 period.”

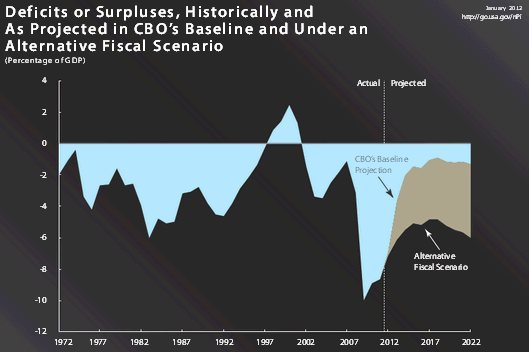

Their baseline scenario shows a dramatic drop in the budget deficit between 2013 and 2014 with declines to 4% of GDP and then 2.3% of GDP in 2014:

“Under current law, CBO projects that deficits will drop markedly, averaging only 1.5 percent of GDP over the 20132022 period. But under an alternative fiscal scenario, in which some changes specified in current law would not occur and certain current policies would continue instead, annual deficits from 2013 through 2022 would be much higher—averaging 5.4 percent of GDP”

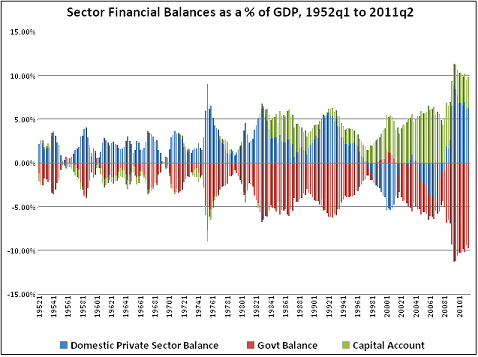

Why is this problematic? Well, we know from MR and an understanding of the sectoral balances that the government’s deficit is the non-government’s surplus. As you can see in the image below, it’s not a coincidence that the last 10 years of economic malaise were preceded by the government running a surplus with a current account deficit at the same time leading to that sharp drop off in the domestic private sector balance (the blue line circa 1998). This was partly alleviated by the private sector debt explosion and the Bush tax cuts which blew the deficit out in the early 2000’s. Ultimately, as the deficit shrank to -3% in 2005 (while running a 6% current account deficit) the only thing keeping the wheels on the bus was the private sector’s incredible thirst for debt (fueled by the housing bubble and an attempt to maintain unsustainable living standards). We all know what happened next. The wheels came off and the only thing that stopped the US economy from going into a full bore depression was the government’s massive spending program (again seen in the blue line circa 2009).

So, the good news is that we’re still running large deficits through 2012 as the private sector heals from the consumer credit recession. We’re even seeing some signs of life on the consumer debt side. This means the de-leveraging is slowing as consumer balance sheets are repaired. The problem is, the CBO sees the deficit dropping off substantially in 2013/2014.

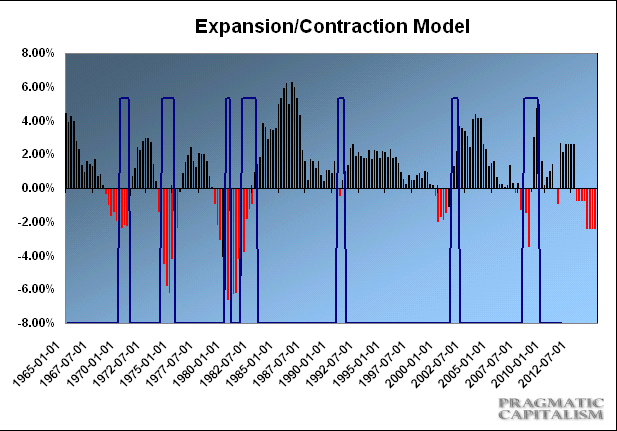

I’ve been working on my economic model since the last time I rolled out its preliminary results and and am now comfortable using it to make economic forecasts. There are a lot of moving parts in here so the model is more of a broad macro outlook, but it should give us some idea of the general trend and where we’re headed and at what sort of trajectory. I’ve built in the CBO’s baseline scenario to show the impact on real GDP. The results show the following:

2012: 2.6% RGDP

2013: -0.7% RGDP

2014: -2.4% RGDP

Now, a lot of this is based on the CBO’s baseline projections for the deficit and these figures are notoriously volatile from quarter to quarter as public policy is unpredictable, but the results point to a steady economy in 2012 with an increasingly unstable environment heading into 2013. We’ll be monitoring this very closely as we move into 2013. I think the coast is clear in 2012 as far as recession goes, but the economy is growing increasingly at risk as we head into 2013/2014. Given the margin of error in the model we’re much more likely to see recession in 2014 than in 2013, but full blown recession in 2012 is likely off the table.

The good (?) news is that the balance sheet recession appears to be having an increasingly reduced impact on consumer debt and de-leveraging. The bad news is that it’s highly unlikely that we’re going to see another debt fueled growth phase like 2004-2007. That might be a good thing, but without larger budget deficits and the constant bleed through the current account it’s becoming increasingly difficult to envision an economic boom after 2012 (I wish I had a rosier forecast). 2013 is looking like a year of very meager growth if the CBO estimates hold true and 2014 is looking like we could be at substantial risk of recession. I’ll update the model on a quarterly basis from here on out to provide readers with a steady update on the outlook.

The upside risk to this model lies with a consumer credit binge (which would be temporary and highly destabilizing in the longer-term) or much larger budget deficits for whatever reason. The downside risks come primarily from government austerity. Stay tuned.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.