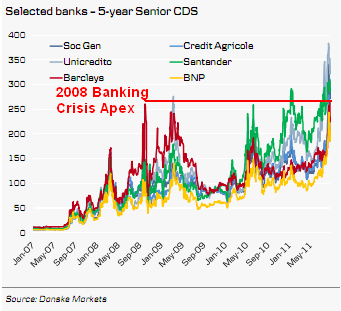

One of the many enjoyable acronyms that became household names in 2008 was CDS – credit default swap. As most investors know by now, these instruments were created to protect bondholders from default. Of course, what we found out in 2008 was that they really just shifted the risk from one investor to the other. Sort of like tossing a hand grenade in a circle hoping you aren’t the one holding it when it goes boom. And as Wall Street imploded on itself in 2008 this game of toss the grenade became increasingly expensive to play as evidenced by the surging cost to avoid the grenade (surging cost of CDS).

What’s frightening about the developments in Europe in recent weeks is that the CDS market is once again sending the same signals. Someone is going to get left holding the grenade again. And this time, the market is actually telling us that it’s even worse than it was in 2008. The only difference is that the problems appear to be across the pond.

The following chart from Danske Bank shows the 5 year CDS rates for 6 of the largest banks in Europe – SocGen, Unicredit, Barclays, Credit Agricole, Banco Santander and BNP. If this market is giving us a cue its message is more than clear – someone’s paying an awful lot to avoid the inevitable explosion and they’re even more eager to avoid this explosion than they were in 2008. Is the market underestimating the risk of further credit contagion? That would appear to be the message from the CDS market.

Source: Danske Bank

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.