If you’ve read my primer on the monetary system you know that the USA isn’t really bankrupt. And you know it can’t technically go bankrupt. That is, the US government can’t “run out of money” because it’s what I call a “contingent currency issuer”. That means the US government always has the ability to pay bills denominated in US dollars because it has a printing press that it can use to pay those bills.

Seems simple enough, but people still obsess over our government not having the money to pay its bills. I don’t know why. Sure, lots of other bad stuff can result from ignorant government spending, but running out of money is not the issue. In fact, with these people it’s usually creating too much money that’s the problem! Ie, inflation is the problem, not solvency. HUGE difference….

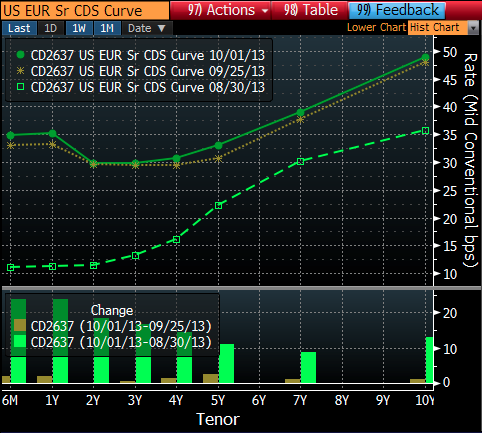

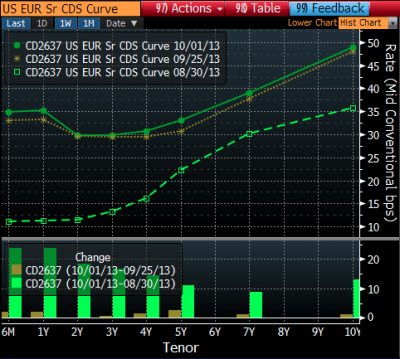

Anyhow, as the circus in Washington moves into its second day it’s interesting to start thinking ahead to the debt ceiling discussions that will emerge in a few weeks. I’ve likened this to holding ourselves hostage. And as it happens it looks like people are buying credit default swaps on US government debt just in case. They used to say that gold was a bet on political ignorance. But it’s now looking like CDS is the way to gain exposure there:

Chart via Simon Hinrichsen

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.