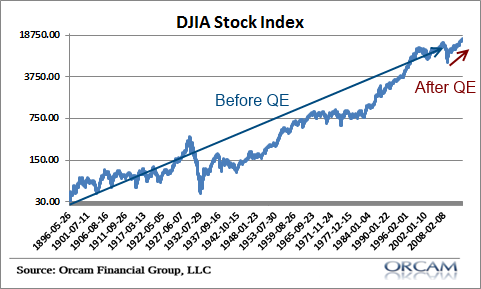

Every time the market takes a tumble these days everyone seems to blame the “taper” or QE. I guess there’s always a need to apply a cause to every market gyration. But I wanted to bring some perspective back to this conversation because I am afraid that some people are starting to think like junkies. They act like drug addicts who think things can never be okay without another hit of this or that drug. In other words, they can’t remember that the US stock market didn’t always have QE. And in fact, it did pretty well before QE ever existed.

Before QE was implemented in 2008 the Dow Jones Industrial Average increased by 350X over the prior 112 years. So let’s keep some perspective here. I know these are unusual times, but that doesn’t mean the US economy is going to be addicted to Fed policy for the rest of eternity. And in fact, if the long-term is any guide, we’re likely to do just okay without relying on QE like a drug all the time. So let’s not think like drug addicts and focus excessively on the near-term here and what some people think is a stock market drug.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.