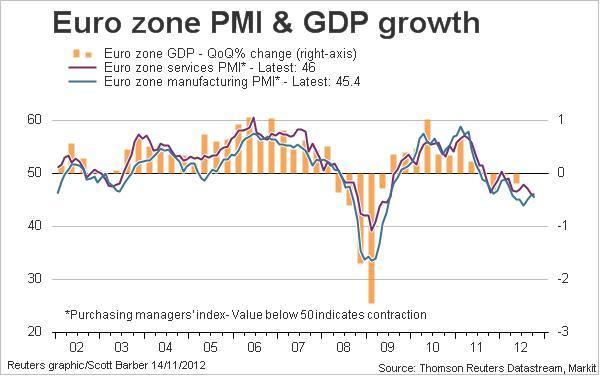

Here’s a good update on the situation in Europe showing Eurozone PMI’s and GDP Growth. The latest services reading came in at 46 while the latest manufacturing PMI came in at 45.4. These readings are consistent with continued recession across the region.

A closer look, however, shows enormous disparity in the underlying data. For instance, Greece, at a reading of 41 is substantially below the average reading in Europe while Germany’s latest reading of 50 is not even contracting.

Taken as a whole though, it’s still bad news for the whole of Europe. And the worst part is, it’s difficult to imagine an improving scenario until the flawed currency union is fixed.

(Chart via Reuters)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.