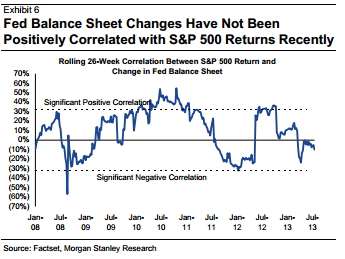

It’s generally noted that QE and the S&P 500 have been positively correlated. But that positive correlation hasn’t remained true through all of the various QE programs. In fact, the 26 week rolling average between the S&P 500 and changes in the Fed balance sheet have been notably negative in the last few months. This doesn’t mean the “tapering” doesn’t matter, but it does appear as though the equity market is becoming less concerned with the risk of a reduced balance sheet. Here’s more via Morgan Stanley:

“While Fed tapering has dominated much of the conversation since June, we feel compelled to reiterate our stance that the Fed will remain extremely accommodative. It is true that the correlation between the week-over-week change in the Fed balance sheet and S&P500 performance began to diminish earlier in the year (Exhibit 6). It is also true, however, that

tapering to $65 billion per month of purchases this month would be equivalent to the announcement of QE2. In other words, we are very far from tightening and expect accommodation to reign.”

Source: Morgan Stanley

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.