One of the dominant themes in economics these days is that low growth means we are worse off. Some people call this “secular stagnation” or something similar. I’ve challenged this view and say this doesn’t account for how stable our economy has become. In other words, it doesn’t adjust for the risks we face.

You see, in portfolio management low growth isn’t necessarily bad. After all, would you rather earn 8% on a rollercoaster ride of volatility or would you rather earn 6% in an incredibly smooth and predictable trajectory? The point is, it’s not just about how high your returns are. It’s about how you achieve those returns. Most people would sacrifice some growth in exchange for greater stability. Likewise, in our economic growth we should be happy to see lower growth if it comes with greater stability.

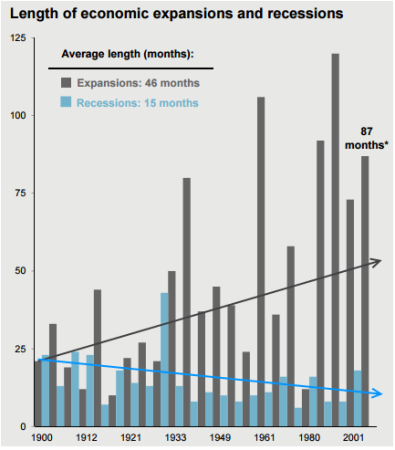

And that’s the trend we’ve been seeing for the last 10, 20, 50+ years. Our economy is mean reverting back to a lower growth rate (global growth has only averaged about 2% per year since 1700 so those 3-4% growth rates of the late 1800’s and 1900’s were a secular boom). And at the same time we’re achieving that lower growth rate with much greater stability as our expansions become longer and our recessions become shorter. Even when you adjust for the depth of downturns, our economy is becoming much more stable (including the 2008 crisis) as the depth of these recessions become less dramatic over time.

(Edited Chart – I added those pretty arrows – via JP Morgan)

This doesn’t mean everything is hunky-dory. Low growth could coincide with other bad effects like greater inequality. But it also highlights the fact that things might not be quite as bad as many seem to believe….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.