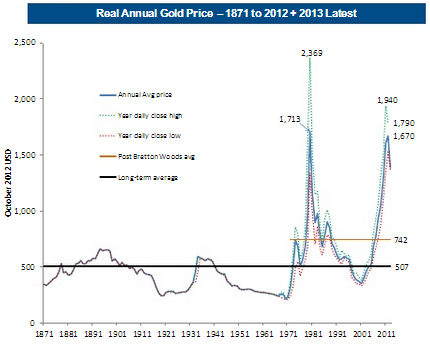

Here’s some perspective on the recent gold rally and decline. Via Goldman Sachs:

- The 2012 average gold price was only 2.5% lower than the 1980 average of $1,711/ounce in real terms.

- The long-term real price average is $507/ounce, and the post Bretton Woods (1972 onwards) average is$741/ounce.

- Despite the latest price drop, prices remain high historically.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.