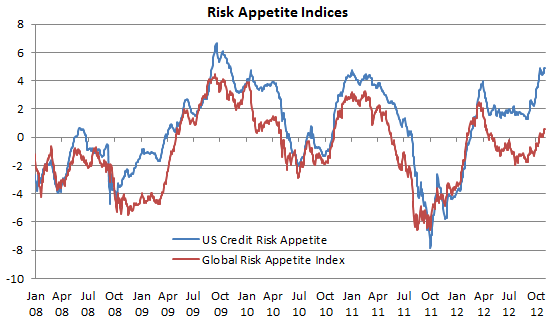

Here’s a good update on risk appetite via Sober Look who brings us the Credit Suisse Risk Appetite Index. The divergence between credit and equity risk appetite in recent years is quite large as credit risk appetite nears its all-time highs:

Below is the famous CS Risk Appetite Index shown together with its US Credit Risk Appetite sub-index. US credit risk appetite is approaching what CS refers to as the “euphoria” level.

CS: – US Credit Risk Appetite is a whisker away from Euphoria while Global Risk Appetite appears range-bound, close to its long-run average of about 1. US CRA being this close to Euphoria suggests caution- riskier corporate credit seems overbought both in absolute terms (yields are near record lows) as well as relative to safer credit. The last time the gap between Global Risk Appetite and US CRA was this large was August 2011, and it did not persist for long.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.