Mary Meeker is out with her annual “Internet Trends” presentation and she continues to promote this very misleading view of the US government as a corporation. For instance, here’s a chart showing the “income statement” of the USA:

Okay, let’s cut to the chase. Governments are not corporations. Corporations exist to increase shareholder value by earning more income. Governments exist to serve a public purpose that the private sector generally cannot or will not earn an income achieving on their own. For instance, national defense is a pretty bad way to make money because you blow up most of your physical assets and deplete your workforce in the process of destroying other people’s stuff. War is a really really bad way to increase aggregate incomes. But national defense is obviously a public good. Without our national defense we probably wouldn’t have most of the great profit generating corporations that we have in the USA because well, we might not even exist.¹

So, the obvious point is that we need the government to exist for certain purposes that the private sector might not want to do on their own or simply cannot do on their own. And many of those activities will not be profitable for the government.² But the fact that they’re not profitable does not mean they’re bad. As I showed with national defense, you can operate in the red in perpetuity and still make a perfectly rational argument that national defense is among the most important things that make private entities profitable. In this sense, it’s kind of like we pay into a public pot for the greater good knowing that that pot is going to be used for purposes that might not have a quantifiable or tangible return on investment.

Tie all of this in together with the fact that a government has solvency and income capabilities unlike any corporation or household and the comparisons become useless and probably reckless.

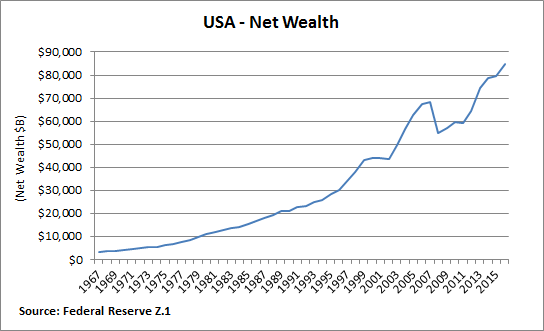

¹ – Here’s a better perspective of how you might show that these annual “losses” actually create an environment of extraordinary shareholder value.

² – Do not confuse these statements for an argument in favor of reckless government spending. Governments are constrained in their spending in specific ways and they can cause extreme harm to their private sectors when mismanaged. But these conversations need to remain within the proper context.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.