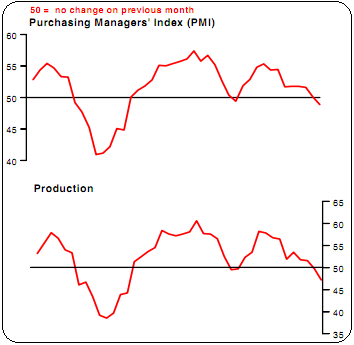

While the world is busy obsessing over the debt crisis in America and Europe there is new evidence that the most important economic region in the world is slowing. The China July Flash PMI from HSBC is showing a contraction. The latest reading came in at 48.9 which is a 28 month low. Readings below 50 show contraction. Is China’s inflation problem finally leading to the inevitable contraction? And more importantly, how will US equities respond to the fact that one of their primary revenue sources is slowing? Via HSBC:

Commenting on the Flash China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & CoHead of Asian Economic Research at HSBC said:

“Headline flash PMI fell below 50 for the first time since July 2010, suggesting slowing momentum of manufacturing activities. This implies that June’s rebound in industrial production was just temporary. We expect industrial growth to decelerate in the coming months as tightening measures continue to filter through. That said, resilience of consumer spending and continued investment in a massive amount of infrastructure projects should support a nearly 9% rate of GDP growth in the rest of the year.”

Source: HSBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.