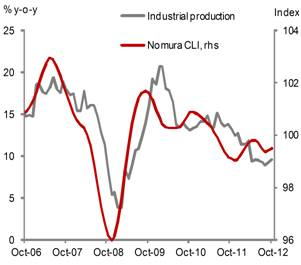

With the recent improvement in China’s PMI and now leading indicators, the worries over the Chinese economy might be a bit exacerbated (via Nomura):

· Our China leading index picked up further in October, with five of the nine components improving (Bloomberg ticker: NMEICLI).

· On a 3-month moving average basis, 58% of the indicators in our heatmap, which tracks 31 indicators, were positive in October, up from a revised 49% in September.

· These results provide further support to our out-of-consensus view of GDP growth rebounding to 8.4% in Q4 2012.

Nomura’s China leading index (CLI) improved for the second consecutive month in October, after a continuous decline from April to August (Figure 1). Five of the nine components registered positive growth in October, led by production of chemical fiber and metal-cutting machines.

Source: Nomura Securities

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.