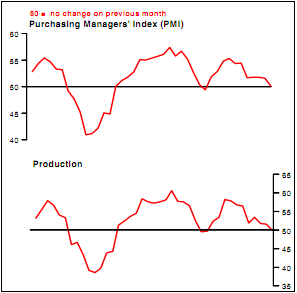

Not a good macro development overnight as China’s PMI comes in at just 50.1 – a smidge above the official contraction level and down from last month’s reading of 51.6. Although this is still technically an expansion, the rate of expansion is slowing across the board with new orders, employment, backlogs, and quantity of purchases all posting slowing growth.

HSBC elaborates on the report:

“Commenting on the Flash China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & CoHead of Asian Economic Research at HSBC said: ‘Demand is cooling thanks to the effect of tightening measures and the slackness in external markets. This, plus the ongoing inventory destocking, has led to a slowdown in output growth. But hard-landing worries are unwarranted not least because the current PMI is at a level consistent with around 13% IP growth. The good news is that inflationary pressures started to ease meaningfully in June amid slowing demand.'”

Source: HSBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.