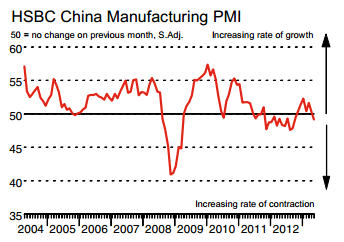

China’s economy still looks very soft based on the latest PMI report. It’s becoming increasingly difficult to find good growth around the globe. Here’s some specifics on today’s report via Markit:

“After adjusting for seasonal factors, the HSBC Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – posted at 49.2 in May, down from 50.4 in April. This signalled the first deterioration in operating conditions in seven months, albeit at only a marginal pace.

Despite operating conditions worsening, manufacturing output rose for the seventh month in a row during May, albeit marginally. Behind the meagre expansion of output, total new orders declined modestly and for the first time since last September. Demand from abroad also weakened over the month, with new export orders falling for the second month in a row. A number of panellists suggested reduced client demand, particularly in the US, had led to the overall reduction in export orders.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.