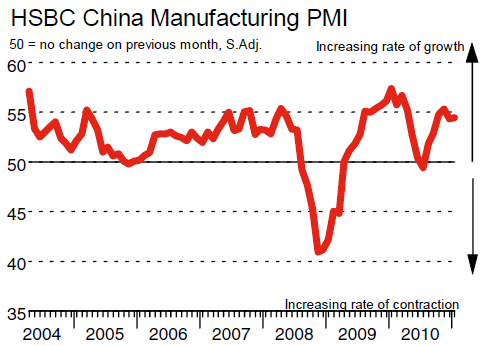

HSBC’s Chinese PMI showed the Chinese economy is off to a strong start in 2011. The headline figure came in at 54.5 which was flat when compared to December, New orders were strong and inflation eased a bit although it remains high (via HSBC):

“PMI survey data signalled that China’s manufacturing sector started 2011 on a strong footing, with both output and new business rising steeply since December. This prompted firms to raise their input buying and allocate resources to meeting incoming new orders, with backlogs of work rising solidly, which in turn encouraged manufacturers to hire additional staff on average. Meanwhile, companies continued to pass on strong cost inflation to clients through increased output charges.

Posting 54.5, up slightly from 54.4 in December, the headline seasonally adjusted HSBC China Manufacturing Purchasing Managers’ Index™ (PMI™) held relatively steady at the start of 2011, signalling a solid improvement in manufacturing sector operating conditions.

New orders rose steeply in January, with the rate of growth quickening from a month earlier, but still down on November’s recent peak. Intakes of new export orders also increased in January, although the pace of expansion was much slower than that for overall new business, suggesting that growth was centred on the domestic market.

January data pointed to another robust rise in Chinese manufacturing production, reflective of stronger growth of overall new business. Nonetheless, capacity pressures continued to build at the start of 2011, with backlogs of work rising at the second-fastest rate since last May. Firms commented that resources had been switched to dealing with incoming new orders. In response to growing capacity constraints, firms continued to hire additional staff in January, although the rate of job creation was only slight.

Purchasing rose sharply in January, with panellists attributing growth to higher output requirements. Some firms also reported raising their input buying in anticipation of strong future sales. Despite this, stocks of purchases fell in January, as firms had to frequently utilise their existing inventories to accommodate for delays in the supply chain. Panellists often linked longer lead times to supply shortages at vendors.

The rate of input cost inflation eased to the slowest in four months, but remained considerable in the context of historical data. Prices paid for copper, steel and fuel were reported as having risen since December. As a result, firms continued to pass on higher costs to clients through increased output charges. Similar to the trend in input prices, the rate of output price inflation eased to a five-month low, but remained much stronger than the long-run series average.

Commenting on the China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:

“China kick-started the New Year with another upbeat manufacturing PMI reading, following the stronger-than-expected 4Q GDP growth release. The strong growth momentum leaves room for Beijing to fully focus on checking liquidity and inflation pressure. Quantitative tightening in the form of reserve requirement ratio hikes will remain the most effective policy tools.”

Key points

• New business growth quickens.

• New export business increases only modestly.

• Cost inflation remains strong, despite easing to four-month low.

Source: HSBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.