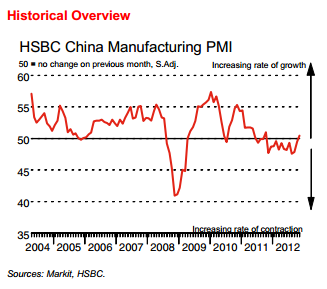

The official Chinese PMI for November hit a 13 month high as the country appears to be avoiding a hard landing. China experienced a year straight of contraction in PMI readings that coincided with a slip in Chinese GDP to its slowest growth in 3 years. At 50.5 this month’s reading is just barely above the expansion line, but a definite improvement off the recent lows seen earlier this year. Markit Economics has more details on this month’s data:

Key points

- Output up for first time since July

- Solid growth of new export orders

- Purchasing activity continues to pick up

Commenting on the China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:

“The final November manufacturing PMI stood at a 13-month high of 50.5 on increasing new business and expanding production. This confirms that Chinese economy continues to recover gradually. We expect GDP growth to rebound modestly to around 8% in 4Q as the easing measures continue to filter through.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.