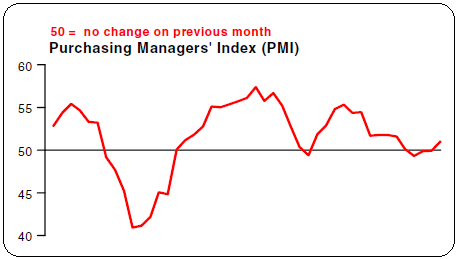

Early reports on October manufacturing in China are showing positive signs. The HSBC Flash PMI is showing expansion with a reading over 50. This is a good sign for the global economy. I have maintained that the US economy is likely to remain weak as the balance sheet recession continues. The double dip recession argument is a moot point so long as the government is running large budget deficits that help to offset the effects of the weak private sector during the de-leveraging. This weakness, however, will make the economy unusually susceptible to exogenous shocks. China and Europe pose the largest risks. This month’s report is a reason for optimism. Now let’s see how hard the Europeans can kick this can they’ve been booting around…..via Markit:

“The HSBC Flash China Manufacturing Purchasing Managers’ Index™ (PMI™) is published on a monthly basis approximately one week before final PMI data are released, making the HSBC PMI the earliest available indicator of manufacturing sector operating conditions in China. The estimate is typically based on approximately 85%–90% of total PMI survey responses each month and is designed to provide an accurate indication of the final PMI data.

Commenting on the Flash China Manufacturing PMI survey, Hongbin Qu, Chief Economist, China & CoHead of Asian Economic Research at HSBC said:

“Thanks to the pick-up in new orders and output, the headline flash PMI rebounded back into expansionary territory during October, marking a steady start to manufacturing activities in 4Q. Meanwhile, inflation components within the PMI results confirmed stable output prices growth and slower input price inflation. All these data confirm our view that there is no risk of a hard landing in China.”

Source: Markit

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.