“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” – Benjamin Graham

Commodities have become an increasingly popular asset class in recent years as faith in fiat currencies has declined, economic growth has stagnated and traditional investments such as equities and bonds have become increasingly unreliable. As demand for hard assets has increased Wall Street has been right there to satisfy this demand with various new products that are sold as “investments”, “hedges” or whatever can help these banks meet their ever increasing need to drive bottom line growth (and take money from greater fools).

Yesterday, Dylan Grice of Societe Generale published what I believe is an incredibly important piece of research showing that commodities are NOT investments. In fact, when you buy a commodity for non-commercial purposes you are speculating. Grice elaborated:

“The fluctuations of commodity prices have fascinated speculators for hundreds of years, but why should investors be interested? Commodities aren’t productive assets, so how can they create wealth over time? And why should they provide investors with a collectable risk-premium? Commodity returns can be decomposed into the “spot” return and the “roll” return. It’s not obvious to me that either are dependable sources of compoundable profit.”

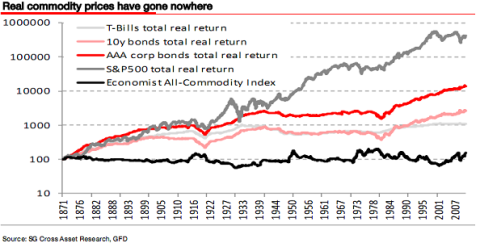

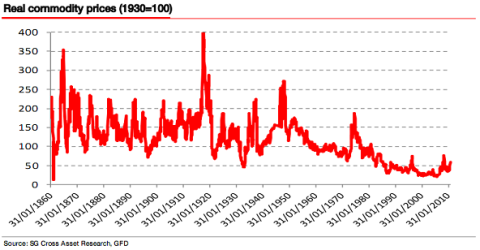

He goes on to show that commodities have actually been terrible investments over the last 140 years *(see more images below):

This makes sense as commodities have no cash flow and the purchase of such assets ultimately involves playing a zero sum game with the hope of one day selling to someone else at a higher price. Seth Klarman, the founder of hedge fund Baupost and of value investing fame, recently described this phenomenon:

“Buying anything that is a collectible, has no cash flow, and is based only on a future sale to a greater fool, if you will—even if that purchaser is not a fool—is speculating. The “investment” might work—owing to a limited supply of Monets, for example—but a commodity doesn’t have the same characteristics as a security, characteristics that allow for analysis. Other than a recent sale or appreciation due to inflation, analyzing the current or future worth of a commodity is nearly impossible.

The line I draw in the sand is that if an asset has cash flow or the likelihood of cash flow in the near term and is not purely dependent on what a future buyer might pay, then it’s an investment. If an asset’s value is totally dependent on the amount a future buyer might pay, then its purchase is speculation. The hardest commodity-like asset to categorize is land, an asset that is valuable to a future buyer because it will deliver cash flow, not because it will be sold to a future speculator.”

Grice added that the purchase of commodities is actually the sale of human ingenuity. You are essentially betting that humans won’t one day replace their oil based energy needs with some alternative energy. Or you are betting that humans won’t find a way to more efficiently produce wheat:

“Why should commodities provide investors with a real risk premium? Shouldn’t prices actually decline in real terms over time? A bushel of wheat, a lump of iron-ore or an ingot of silver today is identical to a bushel of wheat, lump of iron-ore or ingot of silver produced one thousand years ago. The only difference is that they’re generally cheaper to produce because over time, human innovation has lowered the cost of production. When you buy commodities, you’re selling human ingenuity.

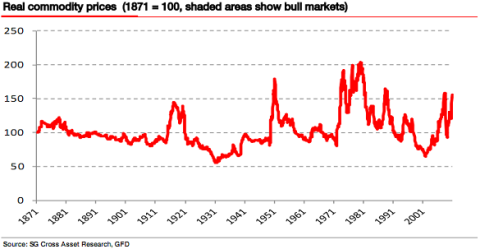

Past performance is no guarantee of future results, obviously, but human ingenuity has a good track record of overcoming nature’s constraints so far. A commodity bull market is really just a bottleneck and as a species we’ve succeeded in bottleneck removal. Historically, most bull markets have ended up where they started.

Why bet against human ingenuity by buying physical commodities when you can bet on it by investing in the enterprises whose task is to remove the bottlenecks and lower commodity prices?”

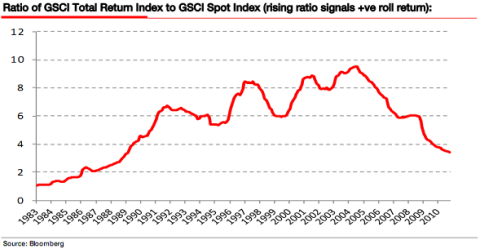

Of course, there is a complexity in the equation here that Grice also tackles. Commodities futures contracts have a built-in risk premium because you don’t transact in the spot price. But Grice finds no evidence that this risk premium necessarily exists. In fact, he finds that commodities markets tend to be in a consistent state of contango therefore creating a negative roll effect:

“If investors had been picking up a risk premium by systematically rolling futures indices their total return would be higher than the spot market return. So the ratio of the total return index to the spot index should steadily rise over time. In fact, the ratio has been zero for the last twenty years.”

“What the chart doesn’t show is that over the past 20 years the GSCI’s annualised total return has been 4.3% despite the spot return being 5.2%. In other words, the ‘roll yield’ has been -0.9%. Since the year 2000 it has been even worse. The GSCI spot return has annualised an impressive 9.9%, but the total return has been only 3.9%. The “roll yield” has been -6%!”

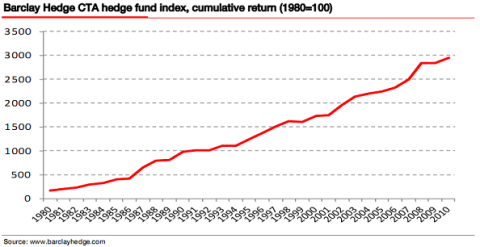

Of course, this doesn’t mean you can’t make money in commodities. As we’ve seen in recent years there are fantastic swings in commodity prices over time and savvy speculators can benefit from such swings. For instance, CTA’s (trend followers) have had fantastic success trading commodities over the last 30 years according to the Barclay’s CTA Hedge Fund Index (the index doesn’t include survivorship bias, however):

The more important takeaway is to avoid believing that you are making an investment when you buy commodities. Rather, you are making a specific speculative bet. The fact that Wall Street has begun selling the idea of “investing” in commodities should play no role in your decision to buy a commodity. In fact, I believe this is just one more case of Wall Street attempting to monetize the ignorance of the general public. If you’re interested in generating sustainable income from commodities you are better off investing in the commodities related companies themselves.

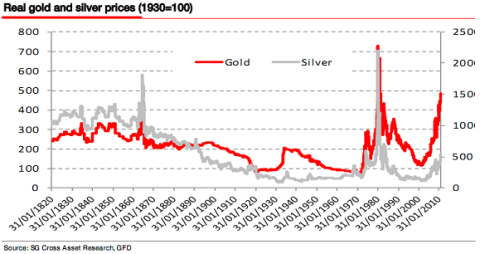

There’s an interesting counterargument that can be made for a commodity such as gold, however. Doesn’t its currency like characteristics make it unique? Seth Klarman says no:

“Gold is unique because it has the age-old aspect of being viewed as a store of value. Nevertheless, it’s still a commodity and has no tangible value, and so I would say that gold is a speculation. But because of my fear about the potential debasing of paper money and about paper money not being a store of value, I want some exposure to gold.”

I would add that Grice’s comments regarding innovation are applicable here as well. Ultimately, a bet on gold is a bet that we will revert back to some form of commodity based currency system which proves the modern fiat monetary system is flawed. But as I have previously explained, I believe this is faulty thinking in the long-run. In fact, the move from the gold standard was a form of financial innovation due to the fact that the gold standard imposed inherent restrictions on the modern complex and dynamic global economy.

What we are seeing in single currency Europe is in many ways equivalent to the flaws generated in a world which was once a single currency world (see here for more). Obviously, that system is highly flawed. And it was these inherent flaws that ultimately led to the demise of the gold standard. A move back to the gold standard would quite literally be like moving back into the stone age.

In the near-term, however, (remembering that all commodities are speculative bets) we can’t ignore the voracious demand for gold as a currency, the problems in Europe, the false belief that the Fed is “printing money” and the misguided belief that fiat currencies are not the wave of the future. As I have repeatedly stated in recent years, it’s likely that gold prices continue to surge higher as investors seek a safehaven from a world of economic uncertainty, political strife and what is viewed as a failing fiat currency in Europe. Ultimately, I still believe gold’s endgame in the current cycle is an irrational bubble, but that is a purely speculative short-term bet and not a long-term investment.

In conclusion, mathematician John Allen Paulos famously said:

“people generally worry only about what happens one or two steps ahead and anticipate being able to get out before a collapse… In countless situations people prepare exclusively for near-term outcomes and don’t look very far ahead. They myopically discount the future at an absurdly steep rate.”

Investors are caught in a wave of euphoria in the commodity markets today. And that’s not to say that it is wrong to own commodities or that their prices won’t be substantially higher in the coming years. But just remember that the product your Wall Street broker so nicely wrapped up for you is NOT an investment. It is a product that is guaranteed to line the pockets of bankers while you make nothing more than a speculative bet that a greater fool will one day buy from you at a higher price.

————————————————————————-

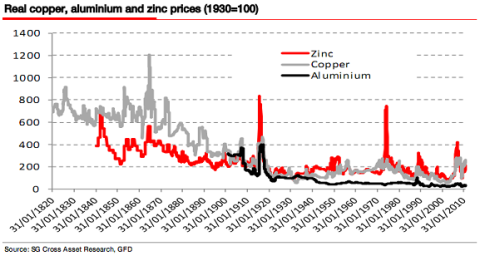

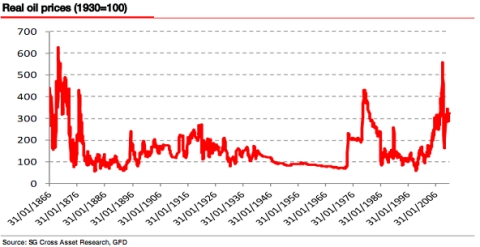

*Additional images provided below:

(Real Commodity Prices)

(Copper, aluminum & zinc prices)

(Real gold and silver prices)

(Real oil prices)

** A special thanks to Gregory White of Business Insider for help with this article

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.