I have to admit that the surge in house prices has surprised me. In May of 2012 I said the risks in the housing market had changed dramatically and favored those who were willing to buy a house:

“the base case here for national real estate is that the risk/reward of buying a home has changed substantially and is no longer skewed to the bear case.”

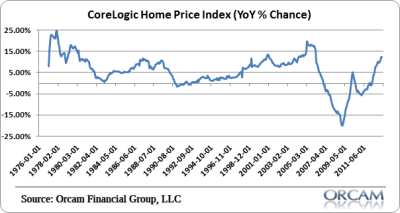

But I did not expect the ensuing 12 months to be as bullish as they have been. According to CoreLogic house prices are up 12.2% year over year. This morning’s update from their Chief Economist was extremely bullish:

“It’s been more than severn years since the housing market last experienced the increases that we saw in May, with indications that the summer months will continue to see significant gains. As we approach the half-way point of 2013, home prices continue to respond positively to the reduction in home inventory thus far.”.

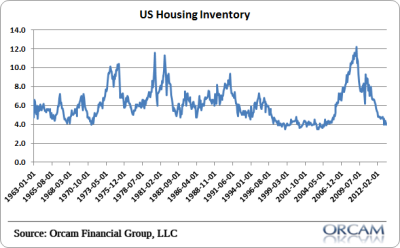

And that’s been the big kicker here. Demand has steadied and inventories have cratered. Months of supply are at trough levels:

This is obviously a sign of better times. But it could also be a sign of a return to the asset based booms that we’ve seen repeatedly in the last 20 years. This sort of year over year change in house prices is fast approaching highly unusual levels which to me, means it’s becoming less sustainable. It would be truly historic if we were able to reinflate a bubble so quickly after one had just burst. Perhaps Fed policy is finally gaining some real traction? Unfortunately, it works largely through the housing market and if the current trends continue then that means more consumer leverage, more Wall Street leverage and it will all be based on unsustainable asset price trends. Sound familiar?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.